Buy Zaggle Prepaid Ocean Services Ltd for the Target Rs.480 by JM Financial Services Ltd.

Zaggle delivered another strong quarter with continued momentum across segments with revenue growing 56% YoY (22% QoQ) to INR 5.3bn, led by sharp rise in program fees per user on an expanding client base. Operating leverage on employee costs and other expenses aided Adj. EBITDA margin expansion by ~80bps YoY to 10.0%. D&A expense increased to 1.9% of revenue as the company capitalises tech investments. Management reiterated its guidance of OCF breakeven in FY26 and OCF positive by FY27, with target of 40-50% EBITDA to OCF conversion in the medium-term. With rising cross-sell penetration, new product traction (Zoyer, Zatix, ZIP), and recent acquisitions bolstering the ecosystem, we believe Zaggle has long growth runway in an underpenetrated market. We reiterate BUY with Mar’27 TP of INR 480 (~58% upside), assigning 25x FY28 P/E multiple, conservative considering the robust growth trajectory.

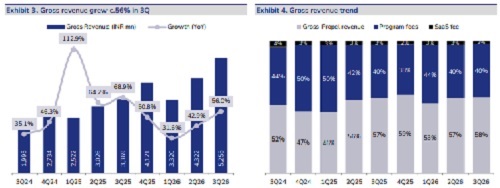

? Growth momentum sustained: Zaggle continued its strong top-line growth momentum with 56% YoY (+22% QoQ) growth to reach INR 5.3bn on account of strong performance across segments. Software fees / Program fees / Propel platform revenue grew 25% / 56% / 58% YoY, driven by 1) addition of new clients and higher users per client, and 2) increased cross-selling and upselling. As of 3QFY26, company has 3,794 corporate customers (+14% YoY) with user base rising to 3.71mn (+17% YoY). Management noted that cross-selling (clients using 2 or more offerings) has improved further from 21% in 2Q. Management reiterated its guidance of 40-45% revenue growth (organic) for FY26 and expects standalone revenue to reach to ~ USD 1bn over the next 5-7 years with new offerings such as Zoyer, Fleet management, Zatix, ZIP contributing to growth.

? Operating leverage leading to margin expansion: Gross margin improved 138bps YoY (+78bps QoQ), mainly due to rising mix of program fees. Adj. EBITDA margin improved 80bps YoY (-10bps QoQ) to 10.0%, driven by operating leverage on employee cost (downsizing of IT team due to increased use of AI) and other expenses, despite increase in incentives and cashback expense (in-line with high transactions in the festive season). Notably, EBIT margin improvement was tad lower at 70bps YoY due to higher D&A on account of capitalisation of new technology and product developments. Management reiterated its guidance of 10-11% EBITDAM in FY26, likely to improve to 14-15% over 4- 5 years on standalone basis. With robust revenue growth, strong operating leverage and cross-sell enabling minimal incremental cost of scaling businesses, we expect Adj. EBITDA to reach ~INR 3.6bn in FY28.

? Maintain ‘BUY’ with Mar’27 TP reduced to INR 480: Basis consistent strong growth in the past quarters, robust growth outlook due to higher cross-sell opportunities, better adoption of new offerings and strong management guidance, we increase our revenue estimates by c.2% over FY26-28E. However, we factor in increased incentives/cashbacks and other expenses to align with growth, leading to 1-2% cut in Adj. EBITDA estimates over FY26-28. Higher D&A expense due to capitalisation of tech cost results in EPS dropping by c.4-5% over FY26-28. We continue to value the company at 25x FY28 P/E multiple to arrive at Mar’27 TP of INR 480 (vs. INR 500 earlier), ~58% upside at CMP. Maintain ‘BUY

? Margins improving but working capital requirement remains high: While margins have steadily improved over the years, working capital intensity remains elevated. Management reiterated its guidance of Adj. EBITDA margin (on standalone basis) increasing to 14-15% over the next 4-5 years; OCF breakeven is expected in FY26 due to stronger inflows in 2HFY26. Further, management expects OCF to turn positive in FY27. Management is targeting steady state EBITDA to OCF conversion ratio to improve to ~40-50% over time, driven by scale efficiencies and working-capital discipline strengthening.

? Update on acquisitions: Zaggle continued to make steady progress on its inorganic roadmap. (1) Greenedge: The company completed the acquisition of Greenedge in 3Q, owning 100% stake for a consideration of INR 200mn along with an investment of INR 250mn. This has already started contributing, aided by strong 3Q performance with INR 290mn revenue and healthier margins. Greenedge benefits from partnerships with Amex for domestic and international golf programmes and NPCI. (2) Taxspanner: Recent draft income tax rules extending employee tax benefits (higher permissible limits for meals/gifts, etc.) to new regime as well is expected to further expand the addressable opportunity. In parallel, TaxSpanner is seeing improved traction driven by changes in tax regulations, with higher compliance requirements around salary structuring, TDS, GST etc. (3) Mobileware, now rebranded as “86400”, is scaling steadily, supported by faster adoption of credit-on-UPI and the addition of ~11 new partnerships in 3QFY26. (4) Rio.Money (now rebranded as Zagg.Money), provides access to a captive salaried user base, which management intends to monetise through cross-selling of BFSI products. The company has entered the retail card segment through partnerships with AU Small Finance Bank and Yes Bank and continues to engage with 2-3 additional banks to expand distribution. Management reiterated that the retail cards opportunity could scale to ~INR 5bn of revenue over the next 4-5 years with EBITDA potential of ~INR 500-600mn. (5) Dice acquisition is on the cusp of completion

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361