Buy Apollo Hospitals Enterprise Ltd for the Target Rs. 9,300 By Prabhudas Liladhar Capital Ltd

Growth momentum to continue across segments

Quick Pointers:

* Six new hospitals to be commissioned over next 12 months with guided EBITDA loss capped at Rs 1.5bn in FY27

* 60% recovery in Bangladesh inflow in Q2

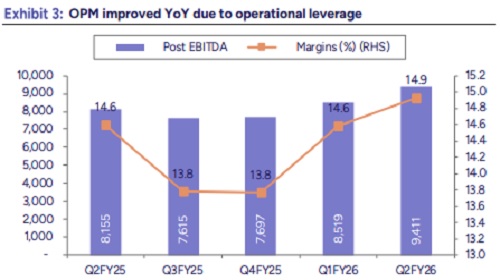

* Apollo Hospitals Enterprise (APHS) reported consolidated EBITDA of Rs9.4bn (up 15% YoY), was largely 7in line with our estimates. Adjusted for 24x7 losses and ESOPs cost (~Rs1.26bn), EBITDA was Rs10.7bn, up 12% YoY. The stake sale in HealthCo to Advent and merger with Keimed are positive moves toward an integrated pharmacy and digital health platform, with Apollo HealthCo scaling up well and its digital business on track for EBITDA breakeven in the next 2–3 quarters. The management guidance of Rs17.5bn EBITDA of the merged entity by FY27 provides comfort. Further, mgmt. has also announced the demerger of its Omnichannel Pharmacy business, 24*7, and telehealth business into a newly listed entity (NewCo) with an aim to unlock value by creating a focused, highgrowth platform in the pharmacy and digital healthcare space, which is more consumer centric in nature. Overall, we estimate 26% EBITDA CAGR over FY25- 28E. We maintain ‘BUY’ rating with TP of Rs9.300/share. We ascribe 30x EV/EBITDA multiple to hospital and offline pharmacy and assign 1x sales to the 24/7.

* Strong growth across offline pharmacy and AHLL; 8% YoY growth in hospital: Consolidated EBITDA at Rs9.4bn; up 15% YoY. 24x7 digital app expenses were broadly flat QoQ at Rs935mn while ESOP related non-cash expenses increased to Rs 324mn (Rs 245mn in Q1). Pharmacy OPM adjusted for 24x7 improved by further 70bps YoY to 8.9%. Apollo HealthCo reported EBITDA of Rs 1.1bn vs Rs 937mn in Q1. Overall hospital EBITDA growth was moderated at 8% YoY with OPM of 24.6%; down 30bps YoY primarily impacted by a ~1% drop in HCS revenue from lower Bangladesh patient inflow. AHLL reported EBITDA of Rs 500mn (up 21% YoY) with 10.6% OPM.

* Healthy growth in ARPP: Overall occupancy stood at 69% Vs 65% in Q1 impacted by seasonal weakness and lower Bangladesh inflow (~1% impact). ARPP growth was up 9% YoY to ~Rs 173.3K; aided led by improved clinical mix and tariff hikes. Overall consol and hospital revenues grew by 13% and 9% YoY, while HealthCo registered 17% YoY growth in revenues. PAT came in at Rs 4.9bn; up 25% YoY. Net cash was largely flat QoQ to the tune of Rs3.3bn.

Key Conference Call Takeaways:

* Bed expansion plan: Mgmt plan to commission six new hospitals within the next 12 months, including Apollo Athena (Delhi – women’s oncology center) and Pune Multispeciality Hospital (both already soft launched in Q3FY26), Sarjapur (Bangalore) and Kolkata by Q4FY26, and Hyderabad (oncology expansion) and Gurugram by Q1FY27. In addition, brownfield expansions are underway at Jubilee Hills, Secunderabad, Malleswaram, and Mysore, taking the total expected addition to over 1,000 beds across FY26–27.

* Guidance on new units: The management guided that EBITDA losses from these new hospitals are expected to be at Rs1.5bn in FY27, with breakeven expected within 12–15 months of commissioning.

* Hospitals: Despite ramp-up costs, established hospital margins are expected to remain stable at 24.5–25%, aided by a cost rationalization program totaling Rs 120 crore annual savings, of which ~60% has already been achieved in H1FY26. Over the medium term, Apollo expects organic hospital revenue growth of 13%, with an additional 5% contribution from new beds as capacity comes onstream. Management highlighted that around 60% of Bangladesh patient traffic has already recovered in October 2025, and the company is exploring newer geographies such as Uzbekistan, Iraq, and select African markets to diversify its international patient base. The focus remains on enhancing the high-value surgical and corporate mix, with metro hospitals already operating above 70% occupancy levels.

* Apollo HealthCo (Pharmacy & Digital): Margins in the pharmacy distribution business were temporarily impacted by one-off integration expenses, though overall profitability continues to improve with better operating leverage. The cost base has been rationalized, marketing expenses normalized, and further synergies are expected from integrating Keimed with Apollo’s offline pharmacy network. Management remains on track for breakeven by end-FY26 or early FY27, supported by scaling of the insurance and diagnostics verticals. The insurance business follows a digital-first hybrid model, leveraging over 10mn Apollo customers through digital channels and a 300-seat call center (to expand to 500). Early traction in NCR and Hyderabad has been positive, with a nationwide rollout targeted by Q4FY26.

* Management reiterated its medium-term target of achieving a Rs 250bn revenue run-rate with ~7% EBITDA margin by Q4FY27, noting that excluding digital losses, the business is already operating at ~6.2% EBITDA.

* AHLL: Management highlighted that competitive intensity remains limited to the diagnostics business, while its Cradle (maternity) and Spectra (specialty surgery) verticals remain relatively insulated and continue to perform well. AHLL, along with Apollo HealthCo, is expected to sustain a 15–20% growth trajectory, while the digital business breakeven remains on course as scale benefits and integration efficiencies accrue.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

.jpg)