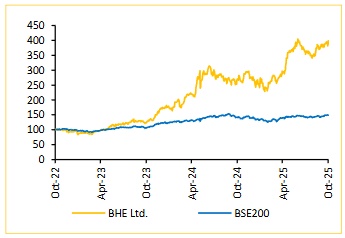

Buy Bharat Electronics Ltd For Target Rs. 500 By Choice Broking Ltd

Confident Outlook; Optimism Ahead

Q2FY26 management commentary reaffirmed our confidence that BHE is well-positioned for a multi-year growth upcycle, underpinned by execution strength, margin discipline and technological expansion. Guidance of 15%+ revenue growth and 27%+ EBITDA margin for FY26 reflects operational confidence. This is supported by a robust INR 75,600 Cr order book (~3.1x FY25 revenue) and strong inflow visibility of INR 27,000–57,000 Cr.

We expect BHE’s focus on system integration and complex defence electronics to drive sustained value creation. The upcoming Defence System Integration Complex (DSIC) in Andhra Pradesh (INR 1,400 Cr capex) positions it to capture high-end programs, such as QRSAM, Project Kusha and NGC.

With over INR 1,600 Cr earmarked for R&D, BHE’s thrust on AI, electronic warfare, UAVs and cybersecurity substantiates its strategy of building futuristic equipment. We believe this transition, backed by strong export traction and domestic sector tailwinds, will sustain doubledigit earnings growth and long-term structural compounding potential.

Strong Q2 Delivery; Broad Beat on Street Expectations

* Revenue for Q2FY26 up 25.8% YoY and up 30.5% QoQ at INR 57.9 Bn (vs CIE est. INR 56.1 Bn), ahead of street of estimates

* EBIDTA for Q2FY26 up 21.6% YoY and up 37.5% QoQ at INR 17.0 Bn (vs CIE est. INR 14.9 Bn). EBITDA margin stood at 29.4%, contracted by 101bps YoY (vs CIE est. of 26.5%)

* PAT for Q2FY26 up 17.9% YoY and up 33.1% QoQ at INR 12.8 Bn (vs CIE est. INR 11.5 Bn). PAT margin contracted by 147bps YoY, reaching 22.1% (vs CIE est. 20.4%)

View & Valuation: We maintain our positive stance on BHE, underpinned by its robust long-term growth visibility, supported by a healthy orderbook and a strong pipeline. Reiterating our ‘BUY’ rating with a target price of INR 500, we value the stock at 40x FY27–28E avg EPS.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131