Sell Suprajit Engineering Ltd For the Target Rs.364 by Choice Broking Ltd

EL Revenue Stagnant, EBITDA Surpasses Estimates, PAT Misses Expectations

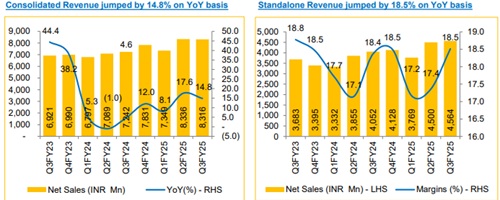

* Revenue for Q3FY25 was at INR 8,316 Mn up 14.8% YoY and down 0.2% QoQ (vs Consensus est. at INR 8 Mn).

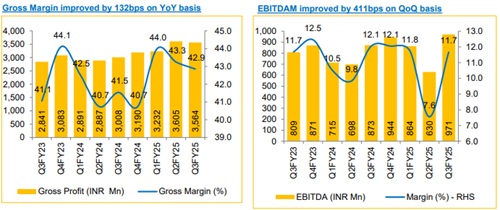

* EBITDA for Q3FY25 was at INR 971 Mn, up 11.2% YoY and up 54.0% QoQ (vs Consensus est. at INR 853 Mn). EBITDA margin was down 38bps YoY and up 411bps QoQ to 11.7% (vs Consensus est. at 10.2%).

* PAT for Q3FY25 was at INR 334 Mn, down 17.0% YoY (vs Consensus est. at INR 355 Mn).

Operational and Market Challenges Impacting Growth:

SEL faces challenges amid moderate growth in the Indian automotive sector, with flat passenger vehicle demand and limited expansion in two-wheelers. Despite this, the industry grew by around 10% for the nine months ending December 2024. Global uncertainties, particularly in the US and Europe, have impacted SCS’s revenue, with the European market contraction weighing on forecasts. The transition from ICE to EVs, potential tariffs, and economic instability add further risks. Additionally, SEL is incurring high restructuring costs due to production shifts to Morocco and the closure of its Poland facility. SCS’s restructuring is expected to continue for a few more quarters, while volatility in the Indian EV market could further pressure profitability and near-term growth.

View and Valuation:

SEL's restructuring and global expansion present both opportunities and execution risks. While production consolidation in Morocco and operational streamlining in Germany may enhance efficiency, they remain exposed to market volatility. Expansion into Canada and Mexico could strengthen its U.S. presence but may strain resources. Considering these factors, we revise our FY26/27 EPS estimates by -8.9%/- 3.2%, adjust our target price to INR 364 (20x FY27E EPS), and continue to maintain our rating to ‘SELL

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131