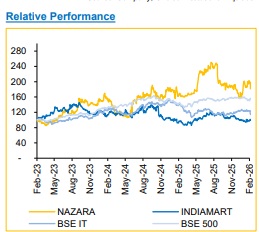

Buy Indiamart Limited for the Target Rs.2,800 by Choice Institutional Equity Limited

IndiaMART delivered a stable Q3FY26, with collections driving growth amid continued softness in subscriber additions. Consolidated revenue grew 13% YoY to INR 4,020 Mn, supported by a 17% YoY increase in consolidated collections to INR 4,260 Mn and 19% YoY growth in deferred revenue, indicating improving forward revenue visibility.). EBITDAM was up 20 bps QoQ while down 560 bps YoY to 33.4% supported by ARPU-led monetisation and a favourable premium customer mix, though partly offset by higher operating costs and continued investments. While collections momentum has improved, subscriber churn (particularly in Silver category) remains the key overhang, with management expecting tangible improvements in FY27E. Near-term performance is expected to remain ARPU-led, with gradual recovery in net additions contingent on churn moderation and sales execution after pricing reset. We retain our revenue growth estimate and model 14.8% revenue CAGR over FY2025–28E. We have, however, trimmed EBITDA estimates by 3.5%, as we model a higher cost structure. We value the company at 25x PE (maintained) to the average FY27E–FY28E EPS of INR 115 and maintain our BUY rating with a TP of INR 2,800.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

Ltd.jpg)