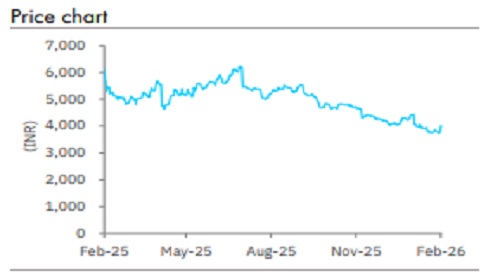

Accumulate Trent Ltd for Target Rs 4,800by Elara Capitals

Not out of the woods, yet

Trent’s (TRENT IN) Q3 revenue was below estimates, though margin beat was aided by lower

rentals and reduced employee costs. LFL growth turned slightly negative amid weak

consumer sentiment, festival season-led front-loading, and elevated competition. We asses

Zudio’s LFL has likely dropped ~5-6% but partly offset by Westside’s LFL growth of ~6-7%.

Store expansion is on track for FY26, but is non-metro heavy (~75% of addition from Zudio

stores) and may keep near-term LFL strained. Growth revival via LFL at Zudio is paramount

for a rerating. Factoring in Q3, we pare our revenue estimates by 3-4%, but upgrade EBITDA

by 1-2% and raise EPS by up to 6%. We lower our TP to INR 4,800 (on lower growth) maintain

Accumulate.

LFL turns negative: Standalone revenue growth of 16.0% YoY fell short of our estimate of 19.6%

YoY as pressure on like-for-like growth mounted further. LFL growth turned “marginally

negative”, from low single-digit in H1, which per TRENT, was led by muted consumer

sentiments, and front loading of festival season demand amidst elevated competitive

intensity. About 75% of Zudio’s store expansion was in non-tier-I market, making sales

growth sticky. In Q3, Zudio added 48 stores (net), taking the total to 854, up 34.5% YoY and

Westside 17 stores (net to 278), up 16.8% YoY, implying an ask rate of 61 store additions (Zudio:

+150 in FY26E). For Westside, we upgrade store addition estimate to +35 for FY26E. We expect

LFL pressure to sustain until revenue profile in the newer markets matures.

Cost prudency aids EBITDAM: Q3 EBITDA margin (Standalone) of 20.4% was ahead of estimates (+c.190bps YoY), to hit a four-year high. The gain stemmed from: a) 30bps gain from grossM (45.0% in Q3), b) 100bps from rental expenses and c) c.60bps from employee costs. Variable payout structures for occupancy costs resulted in lower rental costs, also likely a function of lower costs in non-metro areas. TRENT’s 9M EBITDAM came in at 18.5%. We expect EBITDA margin to be range-bound at 17.5% in FY27E/28E.

Retain Accumulate, TP pared to INR 4,800: Q3 was soft (though with margin surprise). While LFL turned negative, per our assessment: a) Zudio’s LFL dropped by ~5-6%, partially offset by Westside’s LFL growth of ~6-7%, b) gross margin improvement likely aided by rising salience of Westside (a margin-accretive brand than Zudio). While Westside returned to growth, we do not expect a major positive surprise for the stock given the lower scalability for it versus Zudio (lower abs. store adds). TRENT’s near-term growth acceleration depends on revival in Zudio’s LFL momentum and revenue growth at ~20%. Competition may hit growth in fast fashion. So, we may see grossM investment to improve product quality. As Zudio is likely facing a drop in LFL, Westside may drive growth partly, and any slowdown may weigh on overall growth. Monitor non-metro store performance for LFL acceleration. Factoring in Q3, we pare revenue estimates by 3-4% in FY26E-28E but upgrade EBITDA by 1-2% on margin gain, resulting in an EPS upgrade up to 6%. We reduce our TP to INR 4,800 (from INR 5,500) as we value standalone business on pared EV/EBITDA of 35x, Star Bazar at 4x price to sales, and other fashion brands at 30x EV/EBITDA. Retain Accumulate.

Please refer disclaimer at Report

SEBI Registration number is INH000000933