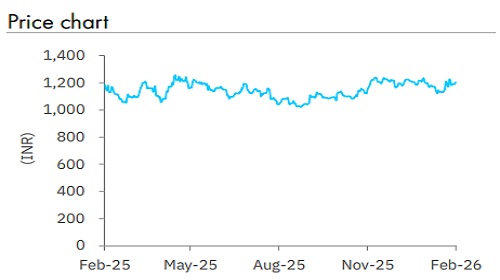

Buy Aurobindo Pharma Ltd for Target Rs1,568 by Elara Capitals

In-line Q3; eyes on regulatory outcome

Aurobindo Pharma (ARBP IN) reported Q3FY26 in line with our expectations with revenue, EBITDA and PAT coming within 1% of our estimates. Higher Other income offset higher tax rate. Management has pegged revenue growth, excluding, gRevlimid at 9% YoY. Gross margin sustained at an all-time high of 59.7% and EBITDA grew 8.9% YoY despite negligible gRevlimid sales in Q3FY26, which is commendable, in our assessment. EBITDA margin improved 20bp QoQ to 20.5% in Q3, again despite lower gRevlimid. Lower losses from the Penicillin-G plant and the INR depreciation helped, in our view. Further ramp-up in Penicillin-G plant along with the USD 24/kg minimum import price (MIP) announced on the product recently by the government will help margins in FY27. Management intends to respond to the recent USFDA observations at the Eugia-III plant within 15 days; indicated that the observations are procedural in nature and are not any cause for concern. The outcome of regulatory inspections, including this one, will be key to stock price performance. We keep our FY26-FY28E EPS unchanged; we retain Buy with a target price of INR 1,568

US business, margin remain resilient; Eugia plant issues not to impact operations: US revenue of USD 420mn was down 3.4% YoY and flat QoQ, but still surpassed our expectations – we had built in a sharper fall once gRevlimid comes off. While there are further growth levers, the outcome of regulatory inspections will be key for this business segment. The Eugia Unit-3 had ramped up after remediation works following USFDA warning letter, but 11 observations in re-inspection have raised concerns. Management says the observations are procedural in nature, and it does not expect an adverse outcome. Regulatory compliance in this plant and other important ones will be events to watch for.

EU and ARV businesses bolster performance; weak API and RoW: The EU business continues to post robust performance with constant currency growth of 11% in Q3FY26. Management expects the growth momentum to continue. The ARV tender business in Africa saw a pickup in Q3 with easing competition; the business grew 16% YoY in USD terms. Growth in ROW revenue (flat YoY) and API revenue, down 9% YoY in USD, came weak in Q3; management expects recovery in the upcoming quarters.

Penicillin-G MIP to help in FY27: The Penicillin-G project is critical for ARBP’s growth and profitability targets. The facility has already ramped up to ~60% capacity utilization and is running at annualized production rate of ~10k tonne. Recent announcement of MIP will help profitability of the plant. Production ramp-up will make ARBP eligible for production-linked incentive payout of ~INR 2.4bn from the government.

Retain Buy with a TP of INR 1,568: We keep our FY26-28E EPS unchanged as of now. The outcome of regulatory inspections, including that of Eugia-III, will be critical, in our view. ARBP trades at 15.9x FY27E core P/E. We retain Buy with a TP of INR 1,568 on 20.5x FY28E core EPS plus cash per share. Escalation of cGMP issues in any of the important plants and delay in Penicillin-G plant ramp-up are key risks.

Please refer disclaimer at Report

SEBI Registration number is INH000000933