Sell Divi's Laboratories Ltd for Target Rs 4,486 by Elara Capitals

Divi’s Laboratories (DIVI IN) reported Q3FY26 marginally below our expectation, with revenue and EBITDA coming in 2-4% lower than our estimates. PAT came in line with estimates, helped by lower tax rate. Topline growth slowed to just ~6.5% YoY in USD terms in Q3. INR depreciation helped report 12% growth in INR terms. After higher 17% USD topline growth in FY25, which came in after two years of a revenue decline, it may moderate to ~10% in FY26E. We believe 10-11% is the sustainable growth rate for the company. A significant spike in capex this year suggests that we could see a spike in growth in FY27 and/or FY28, but that does not change the long-term growth trajectory. Narratives around China + 1 and GLP-1 have kept high growth expectations alive and taken the stock valuation beyond reasonable levels. We raise our FY26E-28E core EPS estimates by 1-3%, due to benefit of INR depreciation. We reiterate Sell with target price unchanged at INR 4,486.

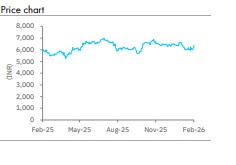

Growth moderation continues; currency depreciation helps: After high-growth in FY25 when topline grew 17% YoY in USD, growth moderated to ~11% in constant currency in H1FY26 and further to ~6.5% YoY in USD terms in Q3. This is in line with what we believe DIVI can deliver in the long term and is also in line with the management’s target of “growing in double-digits, in line with historic growth”. DIVI’s past 10-year revenue CAGR is 8% in USD and 11.6% in INR. However, exceptionally high FY26 capex (INR 15bn already done in H1FY26 versus INR 9bn annual average of past five years) suggests that FY27 and/or FY28 could be high-growth years. We accordingly build in mid-high teen growth in FY27 and FY28, subsequently moderating to low double-digits

Business mix helps margin in Q3: Q3 gross margin was ~300bps higher than recent quarters. We believe higher contribution from the Custom Synthesis business helped. Generics business was down YoY in USD terms. We expect yearly EBITDA margin to stabilize around 33-34% in the near term. We project 33% EBITDA margin for FY26E with yearly improvements thereafter. Given increased competition from several firms in India, it may not be easy for EBITDA margin to expand to a historical peak of 39-40% on a sustainable basis

Best in quality, but over-optimistic narratives built into the stock price: DIVI remains one of the best CDMO plays in India with strong customer relationships, robust chemistry skills and good execution track record. However, its valuation has built in narratives that are unlikely to materialize at the pace of investor expectations. The stock has run ahead of what the company can achieve in terms of growth in its existing business plus potential growth from GLP-1 agonists and the China + One story, in our opinion.

Retain Sell; TP retained at INR 4,486: We raise our FY26E-28E core EPS estimates by 1-3%, due to benefit of INR depreciation. DIVI trades at 59.5x FY27E core P/E. We reiterate Sell. We retain our target price at INR 4,486 (33.4x FY28E core P/E plus cash per share). Any large product opportunity in the custom synthesis business is a key upside risk to our call.

Please refer disclaimer at Report

SEBI Registration number is INH000000933