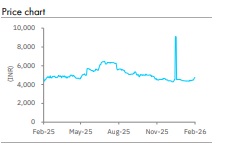

Buy Bayer CropScience Ltd for Target Rs 6,100 by Elara Capitals

Bayer CropScience (BYRCS IN) EBITDA growth of ~5x was significantly ahead of our estimates. Superior EBITDA growth was primarily due to the high base effect on cost across all line items, but change in product mix and cost control have also contributed to EBITDA surge. BYRCS is a pure play uptick in domestic agrochemical s consumption , in our view; hence , a pickup in consumption in FY27 would bolster current EBITDA growth momentum. We revise to Buy to factor in our earnings upgrade by ~11 -17% during FY26 -28E . We r oll forward to Q3FY28E earnings and raise our TP to INR 6 ,100 on 32x Q3FY28E earnings.

Corn seeds business continues to strengthen: Top -line growth of 5% was driven by continued strength in the corn seeds portfolio. Maize crop sowing has grown by 5% in the current Rabi season to 2.9mn hectares. Declining m aize prices (down 27% YoY) are cause for concern , as it hits high -value input consumption. Crop protection sales took a hit from weather volatility. Continu ed rainfall limited the spraying window available to farmers , which dragged liquidation of crop protection. Muted chili and grape season also weighed on demand.

New launches to deliver market share gains and profitability: Portfolio prioritization, market share growth, product launches , and timely lifecycle management are pillars of strategy to improve profitability through the crop protection portfolio. BYRCS plans to prioritize new launches that are significant to make an impact on business and the bottom line. New launches w ould help it regain lost market share in some crops. Since India is among the top five markets of Bayer AG in crop protection, there is a continued focus on increasing distribution reach to gain market share.

Revise to Buy with a higher TP of INR 6100: Cost pressures have peaked. A good season led to high top -line growth , which coupled with cost controls across line items is set to drive significant operating leverage benefits for the stock. We increase our EBITDA by 9% and PAT by 11% for FY26E, by 13% and 11% for FY27E and by 18% & 17% for FY28E , respectively . Hence , we revise rating to Buy from Accumulate with a higher TP of INR 6 ,100 from INR 5 ,167 based on 32x (unchanged) Q3FY28E earnings . Downside risk to o ur call is a risk of deficit monsoon or adverse climatic conditions which impacts agrochemical consumption.

Please refer disclaimer at Report

SEBI Registration number is INH000000933