Add Max Financial Services for the Target Rs.1,990 by JM Financial Services Ltd.

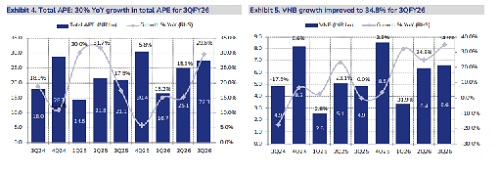

Axis Max Life reported strong APE/VNB growth of 30%/35% YoY. [Link to our first cut] While VNB margin of 24.1% was in line with JMFe, growth was stronger at +30% YoY, +8% JMFe. Management remains confident of sustained outperformance on growth. With Axis Bank (the largest partner) growing strongly in January and strong counter share in seven newer banca partnerships; we raise our APE estimates by 3%/4%/4% for FY26/FY27/FY28E. We cut FY26E margin by 30bps and maintain FY27E/FY28E margin estimates. We estimate 17%/22% APE/VNB CAGR over FY26-FY28E, and value the company at 2.0x Mar’28 EV to get a revised target price of INR 1,990. We maintain ADD.

? With broad-based growth, we raise APE estimates by 3%/4%/4% for FY26/FY27/FY28E: Axis Max Life’s management had guided for a growth of 300-400bps above the industry in FY26, which it has comfortably delivered so far. In concall, the company raised its guidance to 300 to 500bps above industry. With Axis Bank (the largest partner, accounting for 40% of 3Q premiums) growing strongly in January and strong counter share in seven newer banca partnerships, we believe the company can comfortably achieve these targets. Prop channels have already grown strongly – up 30% in 9M/52% YoY in 3Q. Hence, we raise our APE estimates by 3%/4%/4% for FY26/FY27/FY28E. Individual APE grew a strong 29% YoY, substantially higher than RWRP (Retail Weighted Received Premiums) growth of 23% reported to IRDAI. However, on a YTD basis, APE growth was in line with RWRP growth, which management expects will be the trend in future as well.

? Margin in line despite super strong protection growth; we maintain margin estimates: The key high-margin segements of retail protection and annuity doubled YoY while credit life grew 42%. Even within savings, the strong par business came at the expense of ULIPs. Since the 24.1% margin came with a very favourable product mix and stronger-than-anticipated APE growth, we believe margin would be under pressure (but within the guided 24-25% range) for 4Q/FY26E. We cut FY26E margin by 30bps but largely maintain FY26/FY27E margins. Our VNB estimates get upgraded by 2%/3%/4% over FY26/FY27/FY28E while EV increases by 1% for Mar’27 and Mar’28. We estimate 17%/22% APE/VNB CAGR over FY26-FY28E, resulting in a 19% CAGR in embedded value

? Valuations and view: Raise target price to INR 1,990, maintain ADD: Axis Max Life has delivered industry-leading growth and margin in line with private bank-backed peers – HDFC Life and IPRU. At CMP, the stock trades at 2.1/1.8x Mar’27/Mar’28 EV, in line with larger peers – SBI Life and HDFC Life. We believe the valuations are justified given the stronger growth profile and a balanced product mix. With an estimated 17%/22%/19% CAGR in APE/VNB/EV, we raise our target price to INR 1,990 from INR 1,900 earlier, valuing MAXF at 2.0x Mar’28E EV of Axis Max Life. We maintain ADD.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM00001036