Reduce KPR Mill Ltd for Target Rs.1,130 by Elara Capitals

Sugar drags overall profitability

KPR Mill’s (KPR IN) Q4 performance was a miss on revenue, EBITDA and PAT by 19.4%, 26.6% and 32.0% YoY, respectively, versus our estimates. The subdued performance in the sugar segment hit overall growth and profitability. This was partially offset by strong performance in the textiles segment, led by higher volumes in garments and an improvement in textile profitability. Adjusting for Q4 performance and uncertainty in global demand scenario in FY26, we pare FY26E / FY27E earnings estimates by 8.7% / 2.6%, respectively and introduce FY28E. But we maintain our positive stance as KPR is a strong play on India’s garment export theme with robust balance sheet. We raise our TP to INR 1,130, based on 22x FY27E EV/EBITDA (from 18.4x FY27E). However, due to a sharp 37.3% rise in the stock price in past three months and limited upside potential, we revise KPR to Reduce from Accumulate.

Muted revenue growth of 4.3% YoY was impacted by weak performance in the sugar segment, despite a 13.6% YoY increase in sugar revenue, which came off a low base. The growth was largely volume-driven (+11.1% YoY in low-margin sugar), but profitability was weighed down by a 5.4% YoY decline in higher-margin ethanol sales. In contrast, the garment segment posted robust 18% YoY growth, with volume up 7.2%, providing support to the overall performance. Textile grew modestly at 2.3% YoY, with margin expansion of 139bps YoY. Yarn and fabric volumes remained largely flat at 21,440MT. We expect a revenue CAGR of 7.9% through FY25-28E, led by optimum utilization of capacity in sugar and higher garment capacity.

Profitability down despite operating efficiency in textiles: EBITDA margin was down 94bps YoY, led by gross margin contracting 50bps YoY and increase in employee cost by 141bps YoY, which was offset by a 96bps decline in other expenses. EBIT fell by 1.8% YoY to INR 2,806mn, led by a 42.6% deceleration inthe sugar segment but offset by an11.5% growthintextile.We expectEBITDA margin to rise 338bps in FY25-28E to 22.9% by FY27E, led by improved revenue mix (towards garments and ethanol businesses), increase in green power and operating leverage.

Balanced approach to capacity expansion: KPR plans to add 20mn pieces of brownfield garment capacityinQ1FY26.Agreenfieldexpansionisalso inthepipeline.Weassumethegreenfieldgarment facility to have a capacity of 50mn pieces with commissioning in FY27E. Meanwhile, a fabric processing capacity is underway,to be completed in FY26,though timelines are yet to be finalized.

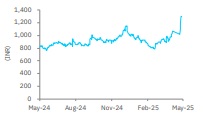

Revise to Reduce; TP raised to INR 1,130: KPR is a long-term play on Indian garment export theme. Its well-integrated manufacturing facilities, focus on capital allocation to higherprofitability businesses and robust balance sheet lend comfort. Given the market access opportunity for garment exporters in the UK, and the potential for a similar scenario in the US and the EU, we raise our target multiple to 22x FY27E EV/EBITDA (18.4x FY27E earlier) to arrive at a raised TP of INR 1,130 (from INR 964). But we revise KPR to Reduce from Accumulate as the stock has run-up a sharp 37.3% in past three months. We are positive on long-term triggers such as garment export opportunity, ‘China Plus One’, ‘Bangladesh Plus One’ and FTAs with key global markets. Key triggers for the stock include announcement of capacity expansion, increase in ethanol prices and improvement in cotton yarn spreads.

Please refer disclaimer at Report

SEBI Registration number is INH000000933