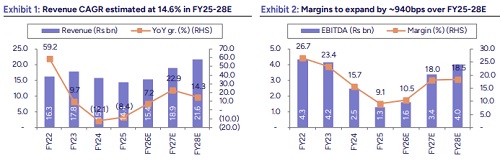

Buy Greenpanel Industries Ltd for the Target Rs. 399 By Prabhudas Liladhar Capital Ltd

Driving growth through efficiency and innovation

We interacted with the management of Greenpanel Industries (GREENP) to gain insight into the company’s ongoing strategic initiatives, cost optimization measures, and market outlook. The discussion covered key areas such as organizational restructuring under new leadership, pricing and volume strategy, and efforts to enhance operational efficiency through procurement and cost control. Management also shared its outlook on industry growth, MDF demand trends, and the company’s roadmap to sustain market leadership through improved utilization, competitive pricing, and strengthened retail and OEM engagement.

Key Takeaways:

* Industry & Demand Outlook: Industry is expected to grow by 15–20% annually, aided by rising MDF adoption and BIS-driven shift toward organized players.

* GREENP aims to balance volume growth and margin recovery through competitive pricing, improved utilization, and procurement optimization.

* Long-term focus remains on maintaining leadership, expanding retail penetration, and improving cost competitiveness.

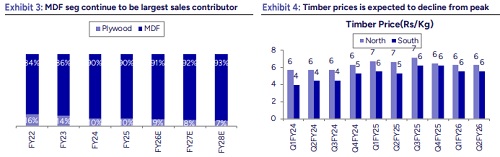

* MDF Segment: GREENP remains focused on consolidating its leadership position in the MDF industry over the next 3–5 years, supported by its strong brand presence and extensive retail network.

* The company has a market share of 22%, with management confident of sustaining this level through continued focus on product quality, distribution, and customer engagement.

* Demand for moisture-resistant and high-density MDF variants is witnessing steady traction, reflecting a growing preference for durable applications.

* Cost Control & Efficiency Initiatives: GREENP continues to place strong emphasis on cost optimization and operational efficiency to enhance profitability and sustain competitiveness. The company is actively working on purchase-side efficiencies, particularly focusing on raw material procurement and the reduction of imported chemical costs.

* Greenpanel maintains a well-diversified mix comprising cashew, mango (longer cycle) and eucalyptus (2-year cycle), with management identifying further scope for cost optimization within the current supply base. The introduction of advanced European machinery has enabled the company to utilize lower-grade raw materials without compromising on product quality, thereby improving cost flexibility and process efficiency.

* Other Highlights: Greenpanel is undergoing a strategic organizational realignment aimed at enhancing operational agility and execution strength. As part of this transition, the company has appointed Mr. Prakash Tripathi as Chief Sales Officer, who joins from Astral, bringing deep industry expertise and a strong track record in channel management.

* Greenpanel has adopted a tactical pricing strategy aimed at driving volume growth and strengthening its market position. The company has undertaken marginal price corrections to stimulate demand, anticipating that peers may follow similar moves—potentially leading to greater industry consolidation.

* GREENP has moderately increased trade schemes and discounts, ensuring continued momentum in a competitive environment. The management’s immediate priority is to enhance capacity utilization levels, with margin improvement expected to follow naturally as operating leverage improves.

* The retail segment contributes 75–80% of total sales, reaffirming its role as the company’s core growth driver. To strengthen its influence and brand visibility, Company has onboarded around 20,000 carpenters, enhancing its ecosystem for demand generation and end-user connect.

* On the institutional front, exports and OEM segments continue to be strategic priorities, though the market remains in the development phase. Exports are expected to account for ~10% of total volumes by FY26, while approximately 40% of current sales are derived from lower-margin OEM and export channels, including EPCG-linked business.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

.jpg)

.jpg)