Buy V-Guard Industries Ltd for Target Rs. 470 by Elara Capitals

Steady topline growth with margin expansion

V-Guard Industries (VGRD IN) continued to post steady topline growth along with margin expansion in FY25. The company continues to maintain its focus on expanding margin through backward integration, with a capex plan of INR 1bn,to be incurred in FY26. It has repaid the entire debt of Sunflame to become a debt free company. We upgrade VGRD to Buy (from Accumulate) with a higher TP of INR 470 (from INR 435) on 38x March FY27E P/E – VGRD is a key beneficiary of the Union Budget-backed consumption theme. It is the second-most diversified electricals company and has underperformed the Nifty by 14% in the past six months.

Cooling products – Demand drives sales: Q4 topline rose 15% YoY to INR 15.4bn, led by robust growth in Electronics, given summer season-led demand for stabilizers. Segment-wise, Electronics grew 26% YoY to INR 4.1bn, Electricals 15% YoY to INR 6.7bn (on a 5% volume growth and 12% price growth in cables & wires) and Consumer Durables 12% YoY to INR 4.1bn. Sunflame fell 24% YoY to INR 553mn. FY25 sales rose 15% YoY to INR 55.8bn. VGRD expects challenges in cooling products due to early rains and a less warm summer versus last year

Focus on margin expansion: Q4 EBITDA margin dipped 20bps YoY to 9.3% due to a drop in Sunflame, expenses incurred (pertaining to a turnaround) and product mix. However, VGRD continues to maintain its focus on expanding margin via backward integration – FY25 margin expanded 40bps YoY to 9.2%. Segment-wise, in Q4FY25, margin for Electronics spiked 660bps YoY to 19.1%, for Electricals rose 130bps YoY to 11.5%, and for Consumer Durables rose 210bps to 3.4%. Margin for Sunflame dropped 830bps YoY to 1.1%. VGRD is investing INR 500mn in a battery manufacturing plant to increase backward integration. The plant is expected to be commissioned in 18-24 months, and may generate INR 3-4bn of throughput.

Sunflame – Turnaround delayed due to weak demand: Sunflame continues to face headwinds as regards its turnaround due to weak demand for kitchen appliances, higher competition (especially in e-commerce channels) and low operating leverage (which hit margin). Sales from the high-margin canteen store department (CSD) were hit by higher inventory in the market, which also impacted margin. However, VGRD is continuing to invest in order to script a turnaround, and expects results in the upcoming quarters..

Upgrade to Buy; TP raised to INR 470: We pare FY26E EPS estimates 7%, on lower demand for cooling products (given early rains), but raise FY27E EPS estimates 3% on improved margin due to backward integration. We introduce FY28E and upgrade VGRD to Buy from Accumulate with a higher TP of INR 470 (from INR 435) on 38x (unchanged) March FY27E EPS.

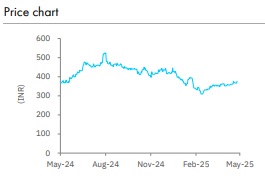

VGRD is a key beneficiary of the consumption theme given its leadership in South India and expanding presence in non-South regions. It is the second-most diversified consumer electricals company. The stock has underperformed the Nifty by 14% in the past six months. Expect an earnings CAGR of 27% in FY25-28E with average ROE of 22% in FY26E-28E. Faster turnaround at Sunflame and improved overall consumer demand are catalysts for a rerating.

Please refer disclaimer at Report

SEBI Registration number is INH000000933