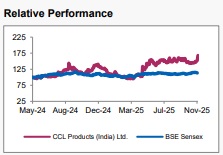

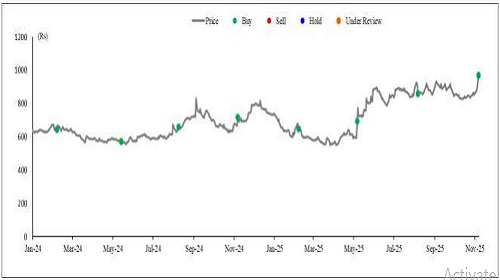

Buy CCL Products Ltd For the Target Rs. 1,140 by Axis Securities Ltd

Stellar Performance; Maintain BUY

Est. Vs. Actual for Q2FY26: Revenue – BEAT; EBITDA – BEAT; PAT – BEAT.

Changes in Estimates post Q2FY26

FY2E6/FY27E: Revenue: 1%/1%; EBITDA: 5%/7%; PAT: 7%/9%

Recommendation Rationale

* CCL Brews another Stellar Quarter: CCL Products delivered a robust performance in Q2FY26, with revenue surging 52.6% YoY to Rs 1,127 Cr, exceeding estimates on the back of strong volume-led growth of 25–30%. Growth remained broad-based across both B2B and B2C segments, supported by market share gains across channels and geographies. The B2C segment contributed Rs110 Cr in revenue during the quarter, reflecting increasing traction in branded sales. CCL continues to consolidate its position as a leading player in modern trade and e-commerce, holding double-digit market share pan-India, and ranking as the #2 player in AP and Telangana. The company maintained its long-term volume growth guidance of 10– 20%, driven by deepening penetration, expansion in smaller pack formats, and rising presence in new markets and channels.

* Resilient EBITDA Despite Cost Headwinds: EBITDA grew 43.8% YoY in Q2FY26, despite a 107 bps contraction in margin to 17.5% due to elevated input costs. Management reaffirmed confidence in sustaining 15–20% annual EBITDA growth, expecting performance to trend toward the upper end of the guidance range, supported by healthy volumes and continued cost efficiencies.

* Debt Moderation on Track: Inventory rationalisation and improved stock utilisation drove stronger working capital efficiency, resulting in a reduction in debt to Rs 1,580 Cr, ahead of guidance. Management reaffirmed its target of bringing net debt down to Rs1,350 Cr by December and Rs1,200 Cr by March, supported by disciplined procurement planning and steady cash flow generation.

Sector Outlook: Positive

Company Outlook & Guidance: Considering the long-term growth outlook, we have increased our FY26/27 estimates and maintain our BUY recommendation on the stock

Current Valuation: 23x Sep’27E EPS (Earlier Valuation: 23x Mar’27E EPS ).

Current TP: Rs 1,140/share (Earlier TP: Rs 970/share)

Recommendation: With a 17% upside from the CMP, we maintain our BUY rating on the stock

Financial Performance: CCL Products’ consolidated revenue for Q2FY26 stood at Rs 1,127 Cr, registering a 52.6% YoY growth. Gross margins declined by 524 bps to 34.5%, due to cost input pressures. EBITDA increased to Rs 197 Cr, up 43.8% YoY, while EBITDA margins declined by 107 bps YoY to 17.5%. The company's PAT stood at Rs 101 Cr, up 36.4% YoY.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633