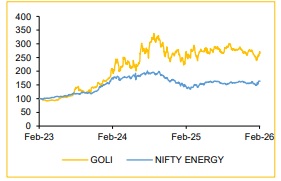

Buy Gulf Oil Lubricants Ltd for the Target Rs.1,600 by Choice Institutional Equity Limited

Timely price hike supports margin coupled with volume growth: GOLI is strategically pivoting its product mix towards high-margin, premium segments so as to drive volume growth and insulating its profitability at the same time. By aggressively expanding into 12 of its 15 operational segments, the company is successfully gaining market share. We are able to conclude this as the industry grows by 3-4% while GOLI continues to grow at 2-3x the market rate, thus increasing its share in overall lubricants market

As acknowledged by the management, there is going to be more of B2C business going forward. In our opinion this will support margin expansion in two ways (a) GOLI will be able to leverage on the brand that it has built over the decade as higher B2C business enhances return on A&P expenses as compared to B2B business, (b) it will be able to exercise pricing leverage, wherein average realised price can be increased through product mix, hikes and schemes even during the falling base oil prices as demonstrated by the firm during Q2FY26

FX volatility has been a headwind for GOLI; however, the company is actively managing currency risks through expert oversight, while a supportive industry pricing environment enables timely price increases to protect margins

Overhang of EV penetration: GOLI has raised its stake in EV charger manufacturer Tirex, from 51% to 65% through an investment of INR 380 Mn, reinforcing its strategic entry into the EV supply chain. Around 25% of electric buses are currently charged using GOLI’s Tirex chargers. We estimate this optionality could scale up to INR 3–4 Bn revenue, adding ~10% to the topline in the next few years with an EBITDA margin of 12–14%.

View and Valuation: We revise our FY27 EPS estimate by -4% while we maintain our target price of INR 1,600. We value the company using DCF model, implying a PE multiple of 13.4x/11.8x at FY27E /FY28E EPS. We reaffirm our BUY rating on the stock.

Q3FY26 Result: Revenue and EBITDA in line, net income lower than expectation

? Revenue was up 10.3% YoY to INR 9.9 Bn (vs CIE est. of INR 9.9 Bn)

? EBITDA was up 6.6% YoY to INR 1.3 Bn (vs CIE est. of INR 1.3 Bn). EBITDA margin was down 45bps YoY to 13.1% (vs CIE est. at 12.95%)

? PAT was up 1.6% YoY to INR 997Mn (vs CIE est. at INR 1,089Mn)

Capacity Ramp-up to Support Volume Growth: GOLI aims to increase its capacity, from 140,000 to 240,000 kilo litres, by FY27. The additional capacity in Chennai is expected to come online by Q1FY27, while Silvassa facility will ramp up by Q3FY27. This in line with our previous assumption and we bake in those volumes in our estimates.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131