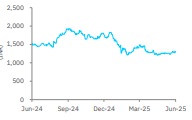

Accumulate Voltas Ltd for Target Rs. 1,330 by Elara Capitals

Summer is not cool in Q1

Voltas (VOLT IN) management expects contraction of 20-25% in room air conditioners (RAC) during April-May YoY and flat June to date YoY. Other categories in the unitary cooling products (UCP) segment also have seen lower-than-expected performance due to weak Summer demand. Star rating changes are expected from January 2026 in RAC, which may lead to pricing pressure in the industry to liquidate inventory. We retain our TP at INR 1,330 on 35x March FY27E P/E. We reiterate Accumulate on better H2 due to good festival season, faster turnaround in Voltas Beko, and recovery of provision in electro mechanical projects (EMP) are triggers to a rerating.

RAC declines 20-25% during April-May: As per management, RAC has witnessed a decline of 20-25% YoY during April-May in the secondary market combined due to a delayed Summer and early Monsoon in most parts of India. June has been flat to date; however, heat waves in some parts of North India could offer respite. If northern demand continues, then July could see a strong performance as North India contributes to 35-40% of RAC sales. Despite weak demand, pricing remains intact, with most brands resorting to freebies, such as free installation, to push volume. Management also expects a cost increase of INR 800- 1,000 per AC from January 2026 once the new BEE norms are implemented due to Star rating decrease, which partly may be passed on to the customer.

Capacity utilization remains low for the new Chennai plant: The new Chennai plant for RAC is currently operating at a low utilization due to subdued demand, with VOLT mostly focusing on optimization of overheads. However, if demand is good in the upcoming quarters, it expects a utilization of 75-80% for this facility. The Chennai facility also has 40-45% of bill of materials (BOM) from in-house manufacturing while the Pantnagar facility only has 15- 20% in-house. In FY26, VOLT expects to supply 1.5mn RAC from Pantnagar, ~0.2-0.3mn RAC sourced from OEM, and the balance from the Chennai plant and OEM, if needed.

Voltbek sees good demand but margin remains low: Voltas Beko is seeing good demand for entry-level refrigerators and washing machines; however, entry-level categories have lower margin. VOLT is looking to localize 100% of production for refrigerators and washing machines in the next 1-2 years. The commercial refrigeration and commercial air conditioning categories both saw lower-than-expected performance, due to weak Summer demand. In the EMP segment, the domestic business sees good growth while the international business continues to see a cautious approach in order booking.

Reiterate Accumulate with a TP of INR 1,330: We retain our TP of INR 1,330 on 35x March FY27E P/E, due to market leadership of VOLT in RAC with pricing remaining intact despite lower-than-expected demand to date. We reiterate Accumulate on better H2 due to good festival season and faster turnaround in Voltas Beko. We expect an earnings CAGR of 17% during FY25-28E and an average ROE & ROCE of 15% and 14%, respectively. The rise in RAC exports, and recovery of provision in EMP are triggers to a rerating.

Please refer disclaimer at Report

SEBI Registration number is INH000000933