Add Bajaj Finance Ltd For Target Rs. 1,140 By JM Financial Services

In-line quarter; MSME stress weighs on growth

Bajaj Finance (BAF) reported an inline PAT (~23%/4% YoY/QoQ, -1% JMFe) driving RoA/RoE of ~4.0%/18.9%. NII grew 22% YoY, 5% QoQ led by 25bps improvement in cost of funds and AUM growth of +24% YoY, +5% QoQ. Flattish other income due to muted recoveries led to PPoP growth of ~21%/5% YoY/QoQ (-1% JMFe). Credit cost remained flat and elevated at 2.0% as GS3 moved up 21bps QoQ to 1.2% led mainly by MSME and captive 2/3W segments. In regard to this, company remains conservative on disbursals in these segments and revised its AUM growth guidance from earlier 24-25% to 22-23% for FY26E. Further, management guided for flat NIMs from here on as cost benefits will be passed on to customers. Fee income growth guidance of ~13%-15% and credit cost of ~1.85%-1.95 in FY26E was maintained. Considering the revision in mgmt. growth guidance, we revised our EPS estimates down by ~2%-3% for FY26/27E. We roll forward our estimates to FY28E and value the stock at ~4.7x/24x Sep-27E BVPS/EPS to entail a revised TP of 1,140. We downgrade the stock to ADD.

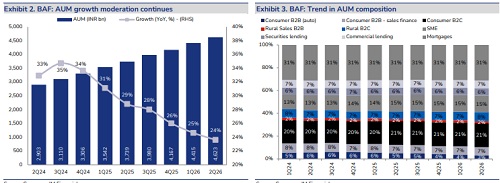

* AUM growth moderation continues; FY26 guidance cut further: AUM growth moderated to 24%/5% YoY/QoQ, led primarily by rural B2C business (44%/10% YoY/QoQ) driven mainly by gold loans (85%/18% YoY/QoQ). Loan against securities grew 26%/8% YoY/QoQ followed by commercial lending (27%/5% YoY/QoQ), urban B2C (25%/5% YoY/QoQ), SME loans (24%/4% YoY/QoQ), urban sales B2B (23%/2% YoY/QoQ). In contrast, the 2/3W saw a steep decline of 25%/9% YoY/QoQ due to rundown in captive segment (-49% YoY). Management guided for GL to grow up to INR 160bn by FY26E and INR 350-370bn by FY27E (vs INR 118bn in Q2). Customer franchise grew 20%/4% YoY/QoQ to 110.6mn and mgmt. plans to add 16-17mn new customers by FY26E. With growing stress across MSME and mortgage, management revised its AUM growth guidance down from 24-25% to 22-23% for FY26E. We reduced our AUM growth estimate by ~1% for FY26E/FY27E both and expect AUM CAGR of 23% over FY25-27E.

* Broadly in-line operating performance: NII growth was healthy at +22%/+5% YoY/QoQ, however, NIM (calc on AUM) remained largely steady (+1bps QoQ) at 9.5%. Calc. CoFs declined 25bps QoQ to 7.1% while yields declined 23bps QoQ. Management guided for NIMs to largely remain flat from here as any further cost benefit will be passed on to customers. Other income was flat QoQ due to muted debt recoveries which is expected to continue while opex grew 18%/4% YoY/QoQ leading to PPoP growth of 21%/5% YoY/QoQ. Credit costs continued to remain elevated at 2% (flat QoQ) which led to an inline PAT (+23%, +4%, -1% JMFe). With revision in AUM growth guidance, we revise our EPS estimates by -3%/-2% for FY26E/FY27E.

* Asset quality deterioration led by MSME and captive businesses: GS3/NS3 moved up +21bps/+11 bps QoQ to 1.24% and 0.61% respectively, with total ECL cover largely stable at 1.7% (-2bps QoQ). The elevated credit costs was mainly in captive 2/3W and MSME business. GS3 has gone up 18bps YoY out of which captive 2/3W bein rundown contributes to 12bps additional GNPA formation and MSME contributes another 6bps. Management maintained credit cost guidance of 1.85-1.95% for FY26E and expect significant improvement in FY27E. We build in avg. credit costs of ~1.9% over FY26E-27E.

* Valuations and view: Considering the revision in mgmt. guidance, we revised our EPS estimates down by -3%/-2% for FY26E/FY27E. We roll forward our estimates to FY28E and value the stock at ~4.7x/24x Sep-27E BVPS/EPS to entail a revised TP of 1,140, thus downgrading the stock to ADD.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361