Buy Indian Bank Ltd For Target Rs.670 by Motilal Oswal Financial Services Ltd

Steady quarter; asset quality continues to improve

Controlled opex and lower provisions led to earnings beat

* Indian Bank (INBK) reported 3QFY25 PAT of INR28.5b (up 34.6% YoY/ 5.4% QoQ, 10% beat), driven by lower provisions and controlled opex.

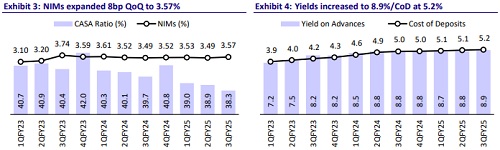

* NII grew 10.3% YoY (in line) to INR64.1b. NIM expanded 6bp QoQ to 3.45%.

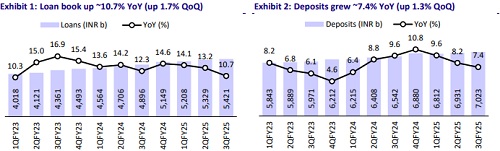

* Net advances grew 10.7% YoY/1.7% QoQ, while deposits grew 7.4% YoY/1.3% QoQ. Consequently, the C/D ratio increased 30bp QoQ to 77.2%. The CASA ratio moderated to 38.3%.

* Fresh slippages declined to INR10.2b vs. INR13.8b in 2QFY25. GNPA/NNPA ratios continued to improve by 22bp/6bp QoQ to 3.26%/0.21%. PCR increased to 93.8%.

* We fine tune our earnings estimates and expect the bank to deliver RoA/RoE of 1.2%/17.3%. Reiterate BUY with a TP of INR670 (1.2x Sep’26E ABV).

Deposits growth modest; NIMs expanded 6bp QoQ

* PAT growth was healthy at 34.6% YoY/5.4% QoQ to INR28.5b (10% beat), led by lower provisions and controlled opex. In 9MFY25, earnings grew 37% YoY to INR51.1b (4QFY25E at INR27.1b, implying 21% YoY growth).

* NII grew 10.3% YoY (in line) to INR64.1b. NIMs expanded 6bp QoQ to 3.45%. The management guides for NIMs of ~3.4-3.5%.

* Other income grew 13.2% YoY (down 11% QoQ) to INR21.5b (in line), resulting in 11% YoY growth in total revenue (in line). Treasury income stood at INR2.6b vs. INR3.3b in 2QFY25.

* Opex grew 5.5% YoY (down 1.8% QoQ, 3% lower than MOFSLe). As a result, the C/I ratio declined 56bp QoQ to 44.6%. PPoP grew ~16% YoY (5% beat) to INR47.5b in 3QFY25.

* Gross advances grew 9.7% YoY (up 1.6% QoQ) to ~INR5.6t, led by Retail (4.4% QoQ). Within Retail, vehicle loans maintained healthy growth trends. Deposit growth was modest at 7.4% YoY (1.3% QoQ). The CASA ratio moderated 54bp QoQ to 38.3%, while the C/D ratio increased 30bp QoQ to 77.2%.

* Fresh slippages declined to INR10.2b vs. INR13.8b in 2QFY25. GNPA/NNPA ratios continued to improve by 22bp/6bp QoQ to 3.26%/0.21%. PCR increased to 93.8%.

* SMA book increased to 1.37% of loans during the quarter and the bank suggested that the SMA issues have been resolved now and no further slippages into SMA are expected. The restructured portfolio declined to 1.23% of loans (vs. ~1.34% in 2QFY25).

Highlights from the management commentary

* Loan book composition: 56% linked to MCLR, 39% to EBLR, and 4.74% is fixedrate.

* The bank applies a flat 10% provision on SMA-2 accounts and a 25% provision on restructured loans.

* The impact of new LCR norms is estimated to be around 8-10%. Even with a 10% impact, the bank remains comfortable with its LCR position.

* Its recovery target is ~INR70b, with INR58b already recovered.

Valuation and view

INBK reported healthy earnings in 3QFY25, led by lower provisions and controlled opex. Global NIMs too expanded 6bp QoQ. However, business growth was modest, which led to a slight increase in the CD ratio. However, the CASA ratio saw a slight moderation. The management expects margins at ~3.4-3.5% and the growth trend to remain steady. The bank will continue to focus on profitable growth. Asset quality ratios have improved, with a best-in-class coverage ratio and lower slippages, which provide comfort on incremental credit costs. The SMA issues have also been resolved, and no further slippages into SMA are expected. We fine tune our earnings estimates and expect the bank to deliver RoA/RoE of 1.2%/17.3%. Reiterate BUY with a TP of INR670 (1.2x Sep’26E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412