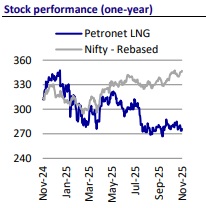

Neutral Petronet LNG Ltd for the Target Rs. 410 by Motilal Oswal Financial Services Ltd

Upcoming projects set to boost earnings!

Petronet LNG (PLNG) hosted a plant visit to Dahej Terminal, Gujarat, attended by MD & Chairman Mr. Akshay Kumar Singh, Director (Finance) & CFO Mr. Saurav Mitra, and other top officials. The company has outlined its 1-5-10-40 vision, targeting INR1t in revenue over the next five years, supported by a plan to deliver INR100b in profits with a cumulative investment of INR400b. PLNG also indicated that all investments are expected to deliver a minimum equity IRR of 16%

Key highlights:

* Third jetty to diversify revenue streams and enhance stability: The upcoming third jetty, entailing capex of INR20b, is capable of handling propane at 45°C, ethane 90°C and LNG at 162°C. The jetty is designed with a total handling capacity of 10mmt for LNG, along with 1.2mmt each for propane and ethane.

* Dahej brownfield expansion offers low-cost growth: The 5mmtpa brownfield expansion at Dahej provides a highly cost-efficient growth opportunity, requiring only 1/10th the investment of a greenfield project, i.e., INR6.5b.

* Unique INR210b PDH-PP project under construction: The planned 750ktpa PDH and 500ktpa PP petrochemical complex installs an integrated heat exchanger system in synergy with the existing LNG terminal. This will result in capex savings of INR4b and annual opex saving of INR1-1.5b (14MW of power savings).

* 900ktpa propane will yield 750ktpa propylene and 34ktpa hydrogen. Hydrogen produced will either be sold or used as fuel gas.

* India’s poly-propylene demand/domestic supply would reach ~15mmt/10mmt over the next three years. Hence, the PDH-PP complex has the potential to supply around 10% of the country’s propylene requirement, bridging the gap.

* Ethane and propane handling is an integral part of the petchem project. Independently, both businesses are delivering 16%+ equity IRR.

* While the company currently maintains a uniform regas tariff, it may evaluate a shift to a differentiated regasification tariff for long-term and annual customers to align pricing with contract terms and market conditions.

* The east coast’s LNG infrastructure is underdeveloped, but the Gopalpur terminal offers strong advantages with National Gas Grid proximity, robust breakwater system, industrial demand potential, and ample land – 80 acres secured from the Odisha government and 200 acres available for future expansion and ancillary facilities.

Valuation and view:

* As per our DCF analysis (WACC: 10.5%), at CMP, PLNG is pricing in an unrealistic scenario of a 20% decline in tariffs at the Dahej and Kochi terminals in FY28, with no tariff hike thereafter and 0% terminal growth. At 8.9x FY27E EPS and a ~4.3% dividend yield, we believe valuations are inexpensive.

* Our DCF-based TP of INR390 (WACC: 10.5%, TG = 2%) assumes a 10% tariff cut in FY28, followed by a 4% rise for both the terminals. While we have incorporated the full capex for the petchem plant, we value it conservatively at 0.5x FY29E P/B and discount this back to FY27.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)