Buy Max Healthcare Ltd for the Target Rs. 1,360 by Motilal Oswal Financial Services Ltd

Steady delivery; bed capacity expansion continues

Existing units deliver strong volume-led growth; expansion pipeline supports multi-year visibility

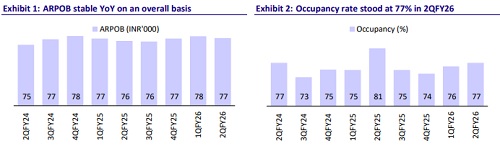

* Max Healthcare (MAXH) reported in-line revenue and slightly better-thanexpected EBITDA in 2QFY26.

* The overall performance was robust, with consistent 20%+ YoY revenue growth and better or in-line EBITDA YoY growth. The bed addition on the brownfield basis is expected to help MAXH sustain the growth momentum going forward.

* For the existing units (network hospitals/facilities started before 3QFY25), revenue growth of 14.4% YoY was largely driven by patient volume, while EBITDA growth stood at 18.6% YoY. Pre-tax ROCE of the existing units is commendable at 26%.

* The scale-up of new units is also on track, with revenue/EBITDA growth of 8%/14% YoY in for the quarter.

* Free cash flow from operations (INR3b/INR7b) has been utilized for ongoing expansions and facility upgrades.

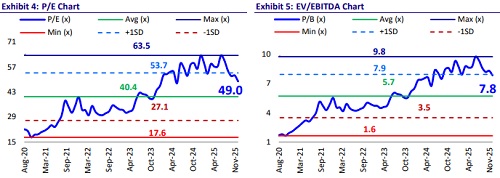

* We largely maintain our estimates for FY26/FY27/FY28. We continue to value MAXH on an SoTP basis (premised on 35x 12M forward EV/EBITDA for the hospital business, 30x 12M forward EV/EBITDA for Max@lab, and 11x EV/sales for Max@home) to arrive at our TP of INR1,360.

* MAXH continues to implement efforts for sustainable growth in revenue/EBITDA/PAT, supported by bed additions (1300 beds in FY26 and ~500 beds in FY27). In fact, the land bank available with MAXH would enable bed additions on the brownfield basis for the next 5-7 years. It continues to optimize case mix/payor mix to further improve profitability. Maintain BUY.

Steady 2QFY26 with strong revenue and stable margins

* In 2Q, Max network revenue (including the trust business) grew 21.4% YoY to INR25.7b (our est. INR26.0b).

* EBITDA margin slightly contracted by 10bp YoY to 26.7% (our est. 25.4%).

* EBITDA grew 21.2% YoY to INR6.9b (our est. INR 6.6b).

* MAXH recorded a one-time gain of INR1.5b from the merger accounting of CRL and JHL (both WoS).

* Adjusting for this one-time gain, ETR would be 21%.

* Accordingly, adj. PAT would be INR4.3b (our est: INR4.4b).

* EBITDA per bed (annualized) stood at INR7.3m for the quarter. Excluding recently added beds, EBITDA per bed was INR7.6m, up 7.4% YoY.

* In 1HFY26, revenue/EBITDA/PAT grew 24%/23%/17% YoY to INR50.2b/ INR13.0b/INR8.0b.

Highlights from the management commentary

* CGHS tariff revision is effective from 13th Oct and expected to contribute over INR2b in incremental annual revenue.

* Temporary insurance cashless disruption fully resolved, with future revision cycles pre-agreed.

* Brownfield expansions progressing: Mohali 160 beds commissioned; Nanavati 268 beds commissioning this week; Max Smart 400 beds within 30 days (EBITDA break-even expected immediately).

* International patient business grew 25% YoY, driven almost entirely by volumes.

* Large multi-city capacity pipeline active across Lucknow, Gurgaon, Nagpur, Patparganj, Saket, Mohali, Vaishali, Thane & Pitampura with timelines ranging 24–42 months.

* Lucknow: Expanding from 413 to 550 beds with onco-radiation/PET-CT launching in 2 weeks; completion by FY26-end.

* Mohali: 400-bed expansion ahead of schedule; expected by end-2027.

* Nagpur: 100-bed expansion awaiting CTE; to complete 24 months after approval.

* Vaishali: 140-bed project with demolition completed; 24-month duration post approvals.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)