Neutral Glenmark Pharma Ltd for the Target Rs. 2,170 by Motilal Oswal Financial Services Ltd

Tough quarter led by GST shock and operational reset

Earnings cut for FY26-28; valuation multiple revised lower

* Glenmark Pharma (GNP) delivered a miss on 2QFY26 earnings, adjusted for a one-time upfront payment received from Abbvie. The miss was largely driven by a severe impact on the domestic formulation (DF) business following the GST transition.

* Adjusting for ISB2001 deal-related income (INR45b for 2QFY26) and associated expenses (INR8.3b), GNP reported an operational loss of INR8.7b for the quarter, representing its highest-ever quarterly operational loss.

* DF sales significantly reduced in 2QFY26 due to uncertainty in the distribution channel following the announcement of GST-related changes on 15th Aug’25.

* In addition, GNP undertook corrective measures to manage inventory levels at the consolidated level. The company also discontinued its pre-collection arrangement with debtors across geographies, resulting in an increase in debtors over the past 6M.

* We cut our earnings estimate by 65%/5%/4% for FY26/FY27/FY28 to factor in: a) the transient impact on the DF business due to GST, b) geopolitical uncertainties in emerging markets, and c) ongoing regulatory issues at certain sites impacting the product approval cycle for the US business. We value GNP at 24x (vs 27x earlier) to arrive at a TP of INR2,170.

* While the overall impact of the GST transition has been significantly higher than anticipated, we expect some business in the coming quarters. With a coarse reset for inventory levels/debtor levels, along with continued focus on growth across key markets and the clinical development of innovative assets, we expect the business to scale up going forward. Reiterate BUY.

GST-related inventory destocking impacts topline

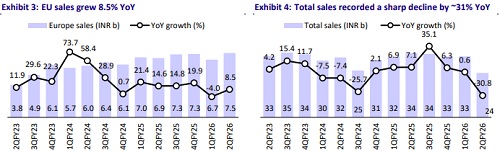

* GNP's sales decreased 30.8% YoY to INR23.8b (our est. INR35.2b). The reported revenue of INR60b comprised one-time income from Abbvie amounting to INR36.7b (USD525m less one-time charge USD93m). Adjusting for the same, revenue for the quarter was INR23.8b.

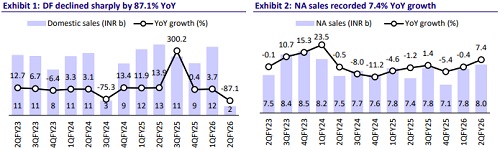

* DF sales decreased by 87.1% YoY to INR1.6b (7% of revenue).

* NA sales grew 7.4% YoY to INR8b (33% of revenue; USD89m down 8% YoY in CC terms). Europe revenue grew by 7.4% YoY to INR8b (33% of revenue; USD89m down; 8% YoY in CC terms). Emerging Markets’ sales decreased 6.5% YoY to INR6.5b (28% of revenue).

* Adj. for one-time income from Abbvie, gross margin (GM) contracted 2200bp YoY to 46.8%. The sharp reduction in Indian sales/lower EM sales impacted GM.

* GNP reported an operational loss of INR8.7b, driven by lower GM and higher opex (other expenses up 1,600bp YoY and employee costs up 1,400bp YoY as a % of sales).

* GNP reported other income of INR2b. Considering the Abbvie income, GNP reported a PAT of INR6.1b. Adj. for Abbvie income, GNP reported a net loss of INR9b for the quarter.

Highlights from the management commentary

* With INR17.5b in cash at the end of FY25 and an additional INR60b from the Abbvie deal, GNP utilized INR13b for debt repayment; INR5b for capex; INR6.5b for bonus and other one-time expenses related to the deal; INR16b for working capital changes; INR5b for cash deficit; INR720m for cash tax; and INR1.5b for interest outgo, leaving cash of INR26b at the end of Sep’25.

* GNP guided for the DF sales run rate of INR11.5b-INR12b from 3QFY26 onwards and targets to achieve INR48b in FY27.

* GNP expects FY27 US sales to be robust, driven by the launch of three exclusive sole FTF products.

* GNP guided for revenue of INR80b and EBITDA margin of 23% for 2HFY26.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412