Buy Macrotech Developers Ltd For Target Rs. 1,625 by Motilal Oswal Financial Services Ltd

Robust performance; double-digit growth across key metrics

Achieves 113% of guided BD

Operational Performance

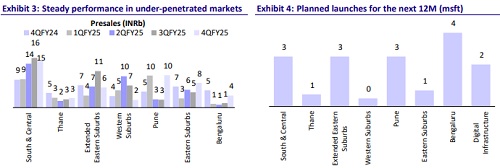

* In Q4FY25, pre-sales rose 14% YoY/7% QoQ to INR48.1b, while volumes grew 4% YoY/15% QoQ to 3.6msf. In FY25, pre-sales grew 21% YoY to INR176.3b, surpassing the guidance. For FY26, the company has guided for pre-sales of INR210b and volumes of 11msf.

* In Q4FY25, collections were up 26% YoY/3% QoQ to INR 44.4b (20% above our est.), while in FY25, collections increased 29% YoY to INR144.9b.

* In Q4FY25, OCF grew 13% YoY to INR23.2b. In FY25, the company reported 26% YoY growth in OCF to INR65.3b, supported by healthy collections. For FY26, the company has guided for OCF of INR77b.

* During the quarter, the company launched seven projects, covering a saleable area of 3.4msf with a GDV of INR33b. For the full year, it launched 9.8msf of projects with a GDV of INR137b across micro-markets. For FY26, the company has guided launches of 13.1msf with a GDV of INR188b across 17 projects.

* Two new projects were added in Pune with a combined GDV of INR43b, bringing the total number of projects in the city to nine. In FY25, the company added 10 new projects (excluding digital infra projects) with a GDV of INR237b across MMR, Bengaluru, and Pune, surpassing its guidance of INR210b.

* For digital infra, the company added two locations in National Capital Region (33 acres) and Chennai (45 acres) and acquired a JV stake in the existing platform. The company has guided for Business Development (BD) of INR250b in FY26.

* Net debt dipped INR3.2b to INR39.9b (vs. INR43.1b in 3QFY25), with a net D/E of 0.20x.

* The company’s credit rating was upgraded to AA (Stable) by Crisil and India Ratings.

* LODHA declared a final dividend of INR4.25 for FY25.

Financial performance

* In Q4FY25, revenue stood at INR42b, up 5% YoY/3% QoQ. In FY25, the company reported in-line revenue of INR138b, up 34% YoY.

* In Q4FY25, EBITDA was up 17% YoY but down 7% QoQ to INR12b (36% above our est.). For FY25, it rose 49% YoY to INR40b (9% above our est.).

* Reported EBITDA margin expanded 285bp YoY to 29% for Q4FY25 and 300bp YoY to 29% for FY25.

* According to management, the embedded EBITDA margin for pre-sales stood at ~32% for the quarter. Adjusted EBITDA (excl. interest charge-off and capitalized interest) stood at INR14.6b, with a margin of 34.6%.

* For FY25, the embedded EBITDA margin stood at ~33%. Adj. EBITDA (excl. interest charge-off and capitalized interest) stood at INR49.6b, with a 36.1% margin.

* In Q4FY25, Adj. PAT came in at INR9.2b, up 37% YoY and down 2% QoQ, with a 22% margin. For FY25, it stood at INR27.6b, up 70% YoY (26% above estimate), with a margin of 20%

Valuation and view: Well-placed to deliver consistent growth; reiterate BUY

* LODHA has delivered steady performance across its key parameters, and as it prepares to capitalize on strong growth and consolidation opportunities, we expect this consistency in operational performance to continue.

* At Palava, the company has a development potential of 600msf. However, we assume a portion of this to be monetized through industrial land sales. We value 250msf of residential land to be monetized at INR528b over the next three decades.

* We use the DCF-based method for the ex-Palava residential segment and arrive at a value of ~INR529b, assuming a WACC of 12.5%. We roll forward our estimates and reiterate BUY with a revised TP of INR1,625.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412