Neutral Bajaj Auto Ltd for the Target Rs. 8,688 by Motilal Oswal Financial Services Ltd

Stable quarter

KTM turnaround to be among the key monitorables

* Bajaj Auto’s (BJAUT) 4QFY25 earnings at INR20.5b were broadly in line with our estimate. Margins remained stable YoY at 20.2% as benefits from favorable currency and improved mix were offset by the impact of stoppage of exports to KTM and higher promotional spends.

* While a recovery in exports and a healthy ramp-up of Chetak and 3Ws are key positives, its market share loss in domestic motorcycles, that too in its bread and butter 125cc+ segment, remains the key concern. Further, the ramp-up of its CNG bike Freedom has been slower than expected. While BJAUT has acquired a controlling stake in KTM under a lucrative deal, its effectiveness depends on how quickly it is able to turn around its operations, which will remain the key monitorable from hereon. At ~26.9x/24x FY26E/27E EPS, BJAUT appears fairly valued. We maintain a Neutral rating with a TP of INR8,688, based on 24x FY27E core EPS.

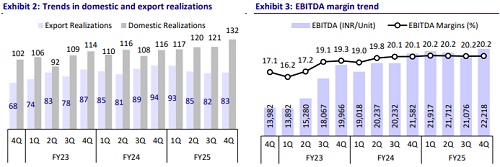

Margins maintained at 20%+ despite increase in EV mix

* 4Q earnings at INR20.5b were broadly in line with our estimate.

* Revenue grew 6% YoY to INR121.5b and was in line with our estimate.

* Gross margin improved 40bp YoY largely due to favorable currency (USD-INR at 86.5 in 4Q vs. 84.3 QoQ and 83 YoY) and a better product mix.

* However, this was offset by the impact of stoppage of exports to KTM and higher promotional spends in 4Q (other exp up 80bp YoY).

* Overall, EBITDA margin remained stable on both YoY and QoQ basis at 20.2% (marginally ahead of our estimate of 20%).

* Overall, PAT grew 6% YoY to INR20.5b.

* For FY25, revenue grew 12% YoY to INR500b, led by 7% YoY growth in volumes.

* EBITDA margin improved 50bp YoY to 20.2% due to an improved mix and favorable currency.

* Overall, PAT grew 12% YoY to INR83.6b.

* The board has approved a dividend of INR210 per share, which translates into a payout of 67%.

* BJAUT delivered FCF of INR65b after investing INR7b in capex. It has also invested INR22b in BACL in FY25.

* BJAUT have a healthy cash and cash equivalent balance of INR170b.

Highlights from the management commentary

* Management expects 2W industry to post 5-6% YoY growth in FY26, largely driven by 125cc+ segment. On the back of its new launches, BJAUT would look to recover its lost market share in the 125cc+ segment and would target to get closer to the market leader in this segment by the end of FY26.

* Management expects exports to grow at 15-20% YoY even in FY26, led by strong growth in Latin America and the Middle East and an expected revival in exports to KTM in 2HFY26.

* While BJAUT has done well in 2W EVs and now is a market leader with a 25% share, supply curbs from China on rare earth metals remain a lingering concern going ahead.

* Management expects input costs to rise 1% QoQ in 1Q. It has passed on about 30- 50% of this increase to consumers. Further, currency is now a headwind for BJAUT as INR is now appreciating relative to USD.

* BJAUT has showcased its intent to take a controlling stake in PBAG, which is the holdco of KTM, subject to regulatory approvals. Once these approvals are in, BJAUT will look to leverage some of the synergies between the two companies, which include: 1) joint sourcing for key raw materials, 2) joint development program, and 3) extension of the current agreement to include joint production of up to 900cc products.

Valuation and view

* While a recovery in exports and a healthy ramp-up of Chetak and 3Ws are key positives, its market share loss in domestic motorcycles, that too in its bread and butter 125cc+ segment, remains the key concern. Further, the ramp-up of its CNG bike Freedom has been slower than expected. While BJAUT has acquired a controlling stake in KTM under a lucrative deal, its effectiveness depends on how quickly it is able to turn around its operations, which will remain the key monitorable from hereon. At ~26.9x/24x FY26E/27E EPS, BJAUT appears fairly valued. We maintain a Neutral rating with a target price of INR8,688, based on 24x FY27E core EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)