Neutral Oil India Ltd for the Target Rs. 400 by Motilal Oswal Financial Services Ltd

Muted volume growth and well write-offs weigh on 2Q performance

* Oil India’s (OINL) 2QFY26 revenue came in line with our estimate at INR54.6b. However, oil/gas sales were 4%/2% below our estimate at 0.83mmt/0.66bcm. Oil realization was USD68.2/bbl (our est. USD67.8/bbl). Adj. EBITDA was 16% below estimate at INR18.4b (-16% YoY). One-off expenses stood at INR5.2b. Exploration cost writeoff/provisions/impairments stood at INR9.8b (INR4.6b in 1QFY26). Reported PAT was 38% below our estimate at INR10.4b.

* Upstream has remained our least preferred sector since Jun’24 (Upstream remains our relatively less preferred sector despite cheap valuations): We have been bearish on crude oil prices since Jun’24 when Brent oil prices were USD83/bbl amid record-high OPEC+ spare capacity (Oil price outlook: Has the crude oil party peaked?). Since then, Brent prices have corrected ~23%, while ONGC’s stock price has corrected ~10%.

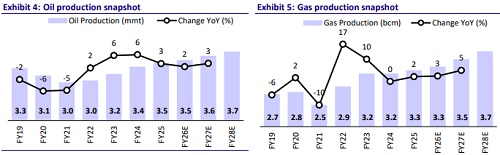

* For FY26, standalone production is guided at 3.55mmt of oil and 3.6bcm of gas, indicating a marginal reduction vs. the previous guidance. For FY27/28, guidance is maintained at 3.8/4mmt of oil and 3.8/4.6bcm of gas. However, in the past few quarters, ONGC has struggled to raise production/sales, with marginal YoY production/sales growth in 1HFY26. Hence, we build in a CAGR of 2.7%/4.2% in OINL’s standalone oil/gas production over FY25-28, reaching 3.7mmt/3.7bcm in FY28.

* We cut our PAT estimates by 8%/9%/10% for FY26/27/28, as we increase exploration cost write-off expenses. We maintain our Neutral rating on the stock and arrive at our SoTP-based TP of INR400 as we model a CAGR of 2.7%/4.2% in oil/gas production volume over FY25-28.

Other key takeaways from the conference call

* OINL budgeted INR70b in standalone capex in FY26, which is likely to be surpassed. Of this, INR55.61b has been incurred.

* Eighteen new wells were drilled in 2Q (100% of target drilling achieved) and 32 new wells were drilled in 1H (28% up YoY).

* PM inaugurated the Assam Bioethanol plant, a JV of NRL on 14th Sep’25. It is India’s first 2G bio-ethanol plant, using bamboo as its feedstock.

* A 200tpd formalin plant has been commissioned in Bongaigaon by Assam Petrochemicals, a JV in the northeast.

* OINL has recovered 109% of its investment in Russia.

Higher-than-expected opex drive miss

* OINL’s revenue came in line with our estimate at INR54.6b.

* Oil /gas sales were 4%/2% below our estimate at 0.83mmt/0.66bcm.

* Oil production fell 3% YoY to 848mmt. Gas production was flat YoY at 804bcm.

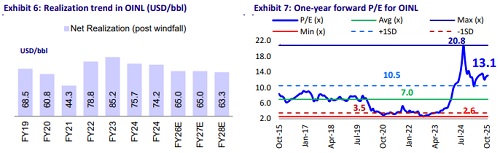

* Oil realization was USD68.2/bbl (our estimate of USD67.8/bbl).

* Adj. EBITDA was 16% below estimate at INR18.4b (-16% YoY).

* During the quarter, OINL exited from one overseas blocks in Gabon and booked impairment expenses of INR1.9b and penalty toward unfinished work program of INR444m.

* The crude oil forward pumping tariff was revised for NRL, with effect from FY19. The total amount arising from this revision up to 30th Sep’25 is ~INR2.9b (including arrears of about INR2.6b up to 31st Mar’25), and this has been recognized in 2Q.

* Exploration cost write-off/provisions/impairments stood at INR9.8b (INR4.6b in 1QFY26).

* Reported PAT was 38% below our estimate at INR10.4b.

* Numaligarh refinery’s 2Q performance: PAT stood at INR7.2b (vs. INR1.8b in 2QFY25), as GRM was USD10.6/bbl. Crude throughput stood at 752.9tmt (up 10% YoY), and distillate yield was at 86.2% (vs. 84.1% in 2QFY25).

* The board declared an interim dividend of INR3.5/share (FV: INR10/share).

Valuation and view

* In the past few quarters, OINL has struggled to raise production/sales with limited production/sales growth YoY. While we like the increased exploration intensity (key to building a robust development pipeline), we believe this will likely be accompanied by high dry well write-offs, which will dent earnings. The benefits of increased new well gas proportion for OINL will be mostly offset by subdued gas realization amid a weak crude oil price outlook.

* Following continued exploratory well write-offs, we cut our FY26/27 SA EPS for OINL by 8%/9%. On our revised estimates, OINL will report SA PAT CAGR of -12% over FY25-28. Given a sluggish earnings outlook, we maintain our PE multiple at 6x on Dec’27E EPS. We maintain our SoTP-based TP of INR400 as we model a 2.7%/4.2% production volume CAGR for oil/gas over FY25-28.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412