Buy Power Finance Corporation Ltd for the Target Rs. 485 by Motilal Oswal Financial Services Ltd

Healthy quarter but weak outlook on loan growth

Asset quality improves, driven by resolutions; reported NIM stable QoQ

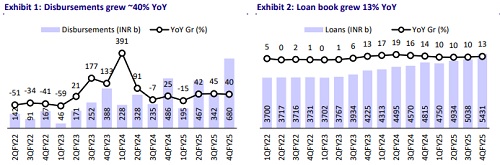

* Power Finance Corporation (PFC)’s 4QFY25 PAT grew ~24% YoY to INR51.1b (~17% beat). FY25 PAT jumped ~20% YoY to INR173.5b. The earnings beat was primarily driven by the write-back of ~INR12b in interest income from the resolution of KSK Mahanadi.

* NII in 4QFY25 grew ~39% YoY to ~INR59.1b (~28% beat). Other income grew ~58% YoY to ~INR11.3b, which included dividend income of INR11.5b.

* Opex declined ~32% YoY to ~INR2.3b (~8% higher than MOFSLe). The cost-toincome ratio stood at ~4% (PQ: 3.9% and PY: ~8.1%).

* Reported yields and CoB in FY25 stood at ~10.02% (9MFY25: 10.07%) and ~7.44% (9MFY25: 7.47%), respectively, resulting in spreads remaining broadly stable QoQ. Reported NIM in FY25 stood at ~3.64% (9MFY25: 3.65%).

* GS3 improved ~75bp QoQ to ~1.95%, and NS3 improved ~30bp QoQ to ~0.4%. PCR on Stage 3 rose ~7pp QoQ to ~80%. Provision stood at INR4.4b. This translated into annualized credit costs of 8bp (PY: -7bp and PQ: 1bp). PFC has created a 100% provision (INR3.1b) against its exposure to Gensol Engineering, which is under investigation for suspected fraud.

* PFC successfully resolved KSK Mahanadi in 4QFY25, in which its total exposure was INR33b. The company recovered 100% of the principal amount and received ~INR12b toward interest income, with the total recovery in KSK exceeding the admitted claim. Provision of ~INR18.1b on this account was reversed and partly utilized (~INR9b) for higher standard asset provisions on discoms, which saw a rating downgrade during the quarter.

* The company highlighted that two projects with total exposure of ~INR16.6b (Shiga Energy with an outstanding of INR5.2b and TRN Energy with an outstanding of INR11.4b) are in advanced stages of resolution. Restructuring plans for both have been finalized, with the documentation and implementation processes currently in progress.

* Management moderated its loan growth guidance to ~10-11% for FY26, citing muted growth expectations in the distribution segments (now that both LIS and LPS schemes are largely over).

* We estimate a disbursement/advances/PAT CAGR of 11%/12%/8% over FY25-FY27, an RoA/RoE of 3%/18%, and a dividend yield of ~5% in FY27E.

Key highlights from the management commentary

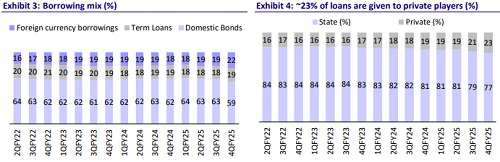

* Management guided spreads of ~2.5% in FY26 and is confident that it should be able to maintain its spreads guidance even in the near term.

* The company increased the PCR on Stage 2 from 0.58% to 1.85%. Part of it was driven by guidance from the RBI, and the rest of it was because of a prudent approach adopted by PFC.

Valuation and view

* PFC delivered a healthy quarter, supported by robust operational performance across key metrics. Disbursements remained healthy, fueling steady loan growth. Asset quality improved further, aided by the resolution of stressed assets, while NIMs remained largely stable on a sequential basis.

* PFC (standalone) trades at 0.9x FY27E P/BV and ~5x FY27 P/E, and we believe that the risk-reward is attractive considering decent visibility on loan growth, further stressed asset resolutions, and healthy RoE of 18-19% in FY26-27E.

* We reiterate our BUY rating with an SoTP (Mar’27E)-based TP of INR485 (based on 1.1x target multiple for the PFC standalone business and INR193/ share for PFC’s stake in REC after a hold-co discount of 20%).

* Key risks: 1) weaker loan growth driven by higher prepayments; 2) increase in exposure to power projects without PPAs; 3) compression in spreads and margins due to an aggressive competitive landscape; and 4) a slowdown in the offtake of renewable energy projects, driven by weak power demand.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412