Buy Global Health Ltd for the Target Rs. 1,390 by Motilal Oswal Financial Services Ltd

Stable ARPOB, strong patient growth

Expansion visibility supports stable growth momentum

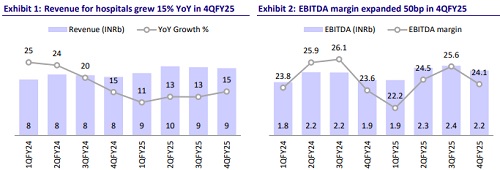

* Global Health (Medanta) delivered slightly better-than-expected revenue/EBITDA (2%/5% beat on estimates) for 4QFY25. However, earnings were marginally below our estimates due to higher-than-expected depreciation and tax rate for the quarter.

* ARPOB was stable YoY in 4QFY25 and FY25, partly due to an increased share of lower-ARPOB Patna hospital and a gradual increase in the share of scheme/PSU-corporate patients.

* Interestingly, revenue growth of 15%/12% YoY in 4Q/FY25 implies highteens growth in the number of patients treated by Medanta across its facilities.

* Specifically, in-patient service (IPD) grew by 16%/12% YoY in 4Q/FY25.

* During the quarter, Medanta undertook the merger of MHPL (its wholly owned subsidiary) into GHL to utilize the export benefits under the EPCG scheme for its Lucknow unit. This has led to a one-time cost of INR499m.

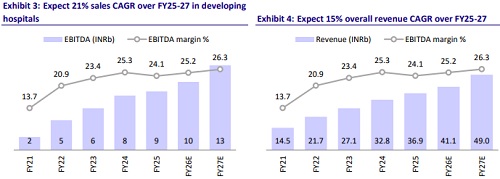

* We reduce our estimates for FY26 by 4%, factoring in additional opex for Ranchi and Noida hospitals and higher material costs due to a rising share of select therapies. We value Medanta at 30x 12M forward EV/EBITDA to arrive at our TP of INR1,390. We estimate a CAGR of 20%/25% in EBITDA/PAT over FY25-27E for Medanta.

* Medanta has a well laid-out plan to add 3,000 beds at existing as well as newer facilities with investment to the tune of INR35b. Specifically, ~1,000 beds are expected to be added over FY25-26 (33% CAGR). The land acquisition is in place, giving better visibility for building the hospital facilities. Demand for healthcare services in focus micro markets for Medanta remains buoyant, implying faster scale-up in occupancy for superspecialty healthcare services. We estimate a CAGR of 20%/25% in EBITDA/PAT over FY25-27 for Medanta. Maintain BUY.

Developing hospitals drive overall performance

* 4Q sales grew 15.2% YoY to INR9.3b. (vs our est: INR9.1b).

* EBITDA rose 17.6% YoY to INR2.2b (vs our est: INR2.1b) with margin at 24.1% (+50bp YoY) for the quarter.

* 4Q ARPOB was stable YoY at INR63.6k.

* IPD/OPD volumes increased 15.9%/12.9% YoY in 4Q.

* Occupancy stood at 61.2% (vs. 59% in 4QFY24 and 63.6% in 3QFY25).

* Mature hospitals’ revenue (69% of total revenue) grew 4.5% YoY to INR6.4b, EBITDA was INR1.5b, and margins contracted 90bp YoY to 24%.

* Developing hospitals’ revenue (31% of total revenue) grew 24.2% YoY to INR2.8b, EBITDA was INR0.9b, and margins expanded 350bp YoY to 31%.

* Medanta had one-time expense of INR499m due to the merger of MHPL (Lucknow entity) with Global Health.

* Adj. PAT grew 9.4% YoY to INR1.4b. (vs our est: INR1.5b).

* For FY25, Revenue/EBITDA/PAT grew 12.7%/7.6%11% YoY to INR36.9b/INR8.9b/INR5.3b.

Highlights from the management commentary

* The board has approved a project to build a 400-bed hospital in Guwahati. Land purchase is in progress. The total investment is expected to be INR5b.

* The construction at Noida is in full swing and the facility is expected to start operations from 2QFY26 onwards.

* Ranchi Hospital is expected to become operational in 2QFY26.

* More than 119 doctors were on-boarded in FY25 across Medanta network hospitals.

* Medanta Lucknow crossed the milestone of 250+ kidney transplants since inception, establishing itself as a leading center for renal transplantation in the region.

* International patient revenue rose 17% YoY to INR557m for the quarter.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412