Reduce Tata Technologies Ltd for the Target Rs. 640 By Prabhudas Liladhar Capital Ltd

Turnaround taking shape, yet valuation leaves little room for error…

Quick Pointers:

* Beat on both Revenue & Margin, Non-auto business drives growth

* Es-Tec acquisition to be completed in Q3

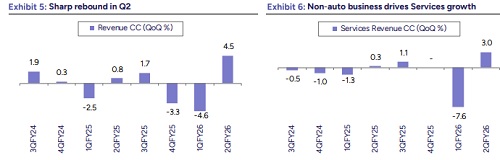

The revenue performance (+4.5% CC QoQ) exceeded our expectation of sequential de-growth (-2.3% CC), attributed to outperformance in non-Auto Service and Passthroughs within Tech Solutions. Aerospace and IHM grew 14.8% QoQ, while the Technology Solutions portfolio rebounded 7.6% QoQ. Surprisingly, Auto segment delivered positive growth despite the operational glitch (limited impact) within its top account, the demand recovery beyond marquee accounts has stabilized and aided growth. The engagement within Aerospace is progressing well and moving upstream to complex engineering activities, ensuring continued steady double-digit growth. Q3 is expected to see a slowdown in the Auto segment due to the phased recovery within topaccount that will partly offset by seasonal uptick in Technology Solutions, before a further rebound in Q4. The BMW JV is also progressing well and deployed 1000+ employees (beyond earlier milestone) in Q2, adding further visibility for next year. We are also factoring in ES-Tec acquisition that is expected to integrate in Q3, with that the organic growth for FY26 revised upward to -1.2%/11.0% (earlier -3.5%/10.1%) YoY CC for FY26E/FY27E. On margins, the beat was notable due to revenue outgrowing our estimates, we are passing on partial benefits due to unanticipated risk in Q3. We are revising our margin estimates upward by 40bps/30bps for FY26E/FY27E, assuming margin profile of ES-Tec is in line with Consol. We upgraded our rating to Reduce (from SELL) and set a revised TP of Rs. 640, valuing stock at 29x Sep27E LTM earnings.

Revenue: Tata Tech reported revenue of USD 145.3 mn, up 4.5% QoQ in CC (6.4% QoQ in INR) led by strong recovery in Aero and IHM, which grew 14.8% sequentially. The services segment recorded revenue of USD 112.5 mn, up 3% QoQ in CC. Within services, the auto vertical (83% mix) stabilized with 0.5% QoQ growth, while non-auto segments such as Aero and IHM drove the bulk of expansion. The technology solutions portfolio delivered robust 7.6% QoQ growth, aided by rebound in education projects and traction in products business.

Operating Margin: Tata Tech reported EBIT margin of 13.4%, down 20 bps QoQ above our estimate of 12.6%. The margin beat was largely due to strong revenue performance. Segment wise, Services segments EBITDA margin improved by 230 bps QoQ while Tech Solutions EBITDA margin declined by 70 bps QoQ. JV contribution came at Rs. 53.1 mn compared to Rs. 48 mn in Q1 driven by stronger than expected ramp up.

Deal Wins: Tata Tech closed three large deals in Q2 including a Tier-1 auto supplier consolidation deal, a heads-up display project for a Scandinavian OEM, and a body engineering deal with a German OEM. Management noted that Q2 deal closures were stronger than the previous quarter, with improving decision cycles and a healthy pipeline heading into H2.

Valuations and outlook: We estimate USD revenue/earnings CAGR of 7.5%/15.2% over FY25-FY28E. The stock is currently trading at a PE of 32x FY27E earnings, we are assigning P/E of 29x to LTM Sep. 27E earnings and arrive at a target price of Rs. 640. We upgrade our rating from SELL to “Reduce”.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

.jpg)