IT Sector Update : Accenture 1QFY26 result read-through: Environment unchanged by Motilal Oswal Financial Services Ltd

Accenture 1QFY26 result read-through: Environment unchanged (for now)

FY26 organic guidance maintained; outsourcing deal momentum improves

Accenture (ACN) reported organic YoY constant currency (cc) revenue growth of 5% in 1QFY26, beating consensus estimates and coming in close to the top end of its quarterly guidance. For FY26, ACN maintained its organic YoY cc growth outlook of 0.5–3.5% (1.5–4.5% excl. DOGE impact). There is still no change in discretionary demand, and management reiterated that overall spending remains consistent with last year, with no macro catalyst yet. That said, we believe the groundwork for the next AI services cycle is gradually starting. Client conversations are increasingly shifting from experimentation to readiness, focused on cleaning up data, modernizing platforms, and securing systems so AI can be deployed at scale.

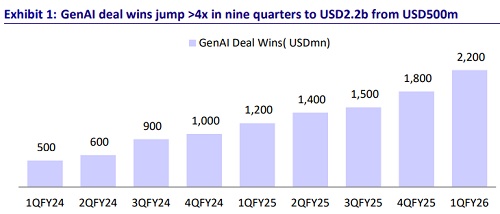

Over half of ACN’s advanced AI engagements are now triggering data-modernization work. GenAI bookings remained strong at USD2.2b (+83% YoY), and overall bookings crossed USD20b, indicating improved momentum in outsourcing deals. Going forward, ACN will discontinue separate AI-metrics disclosures, as advanced AI is now embedded across nearly all client engagements.

Fixed-price contracts now account for ~60% of revenue (up ~10ppt over the past three years), reflecting the rising client preference for outcome-based models. This shift is beginning to show up in metrics: revenue per employee grew 7% YoY, aided by non-linear delivery models. We believe margins will be important to monitor as the industry moves to outcome-based pricing (see our report dated 19th Sept’25: GenAI and IT Services: The waiting game).

As we mentioned in our upgrade note dated 24th Nov, 2025: Time to buy the next cycle, we expect AI services demand could begin to improve from mid-2026 as hardware-led AI capex intensity moderates and spending gradually shifts toward software, platforms, and services. The March-April 2026 budget reset period may serve as an initial indicator, with some AI programs potentially transitioning from preparation to early deployment. In this context, ACN’s commentary on AI-led deal activity, improving productivity, and deeper AI-led client integration appears broadly consistent with our view.

FY26 organic guidance maintained at 0.5-3.5% (1.5-4.5% adjusting for DOGE impact); outsourcing deal wins up 17% YoY

* Revenue performance: Revenue stood at USD18.7b in 1QFY26, marking a 5% YoY cc growth (~3.5% organic YoY cc), near the upper end of the guidance range of 1% to 5%. Managed services revenue grew 7% YoY CC, while consulting services grew 3% YoY CC.

* Bookings in 1Q: ACN reported outsourcing bookings of USD11.06b, up 17% YoY, while consulting bookings rose 7.2% YoY at USD9.9b. The book-to-bill ratio came in at 1.1x in 1QFY26, in line with the average of 1.2x over the past four quarters. Gen-AI bookings for the quarter stood at USD2.2b, up 83.3%/22.2% YoY/QoQ.

* Revenue guidance: ACN expects 2QFY26 revenue growth in the range of 1% to 5% YoY CC and continues to project its FY26 revenue growth guidance in the range of 2%-5% (excluding 1% impact from the US federal business). With an estimated FY26 inorganic contribution of ~1.5%, the organic growth guidance for FY26 stands at 0.5%-3.5%.

* Vertical-wise performance: Growth was led by Financial Services (12% YoY cc), while Products/Communications/Resources verticals grew 4%/8%/2% YoY cc each.

* Operating margin performance: Adj. EBIT margin rose 30bp YoY to 17% in 1Q. For FY26, adj. margin was maintained in the range of 15.7% to 15.9%.

* Muted headcount addition: ACN workforce growth rose QoQ by 1% to ~784k, while attrition dropped 200bp to 13% (vs. 15% in 4Q) and utilization stood at 93%.

Key highlights from the management commentary

* The pace of overall and discretionary spending remains similar to last year. There is no clear macro-level catalyst visible yet.

* Digital core capabilities—cloud, data, and platform monetization—are critical for AI adoption. Underlying data and processes need to be streamlined and governed. Accenture is modernizing data platforms and using AI to improve data quality. At least one out of every two advanced AI projects leads to a datamodernization initiative.

* Technology is evolving rapidly. The total addressable market for AI is expected to grow from USD20b to USD70b.

* Over 1,300 clients (out of ~9,000) are currently engaged in AI-related work, though adoption remains nascent as enterprises need significant preparatory work. Around 100 new clients are initiating AI programs each quarter.

* Banking, finance, procurement, and customer service functions are relatively data-ready and are seeing faster AI adoption. Unlike prior technology cycles, AI adoption is occurring across industries in parallel.

* Accenture expects 2QFY26 revenue growth in the range of 1%–5% YoY in CC, and has reiterated its FY26 revenue growth guidance of 2%–5% (excluding a ~1% impact from the US federal business).

* Health and Public Service: The federal business performed better than expected. EMEA and APAC are shaping up well, supported by sustained investments over the last three years.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Insurance Sector Update : Single-digit growth in private individual WRP in Feb`25 by Motilal...

.jpg)