Buy Centum Electronics Ltd For Target Rs. 3,000 By Choice Broking Ltd

Measured Quarter; Bright Future Expected

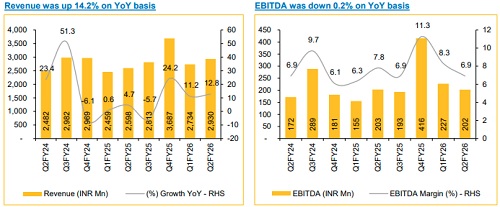

CTE reported a modest Q2FY26 performance, with revenue rising 14.2% YoY, which was below our estimate. The performance was driven by execution in its built-to-spec (BTS) business for domestic defence and space customers. The company’s domestic order pipeline remains healthy, with the BTS orderbook at INR 650–665 Cr and EMS orders at INR 763 Cr. BTS execution is expected over 2–2.5 years, while the timeframe for EMS orders is 10 months.

We believe strategic partnerships continue to strengthen CTE’s positioning, including MOUs with GRSE for naval navigation systems and BEL for defence electronics, as well as contribution to ISRO’s CMS-3 GSAT-7R program. We expect management remains focussed on operational efficiency and targeted CAPEX. Expectation of a strong H2FY26, with standalone revenue growth of ~30% and EBITDA margin of 13–15% for the full year.

On the international front, Europe faces near-term headwinds from macro weakness, competition and project delays, while Canadian operations are under divestment. Losses from overseas subsidiaries are expected to moderate in H2FY26. Looking ahead, CTE is well-positioned to capitalise on opportunities in space-based surveillance, EW payloads and naval electronics over the medium term.

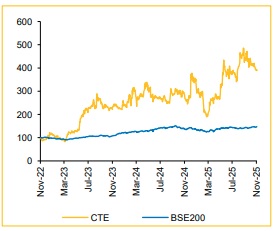

We maintain a positive outlook on CTE, expecting Revenue /EBITDA /PAT to expand at a CAGR of 19%/29%/51%, respectively, over FY26 – 28E. We value the stock at a PE of 35x on the avg. of FY27–28E EPS, implying a target price of INR 3,000. In view of the recent correction in the stock, we have upgraded our rating to BUY (from ADD).

Steady revenue traction with improving profitability trend

* Revenue for Q2FY26 up 12.8% YoY and up 7.2% QoQ at INR 2,930 Mn (vs CIE est. INR 3,052 Mn)

* EBIDTA for Q2FY26 down 0.2% YoY and down 10.9% QoQ at INR 202 Mn (vs CIE est. INR 259 Mn). EBITDA margin stood at 7.1%, contracted by 102bps YoY (vs CIE est. of 8.5%)

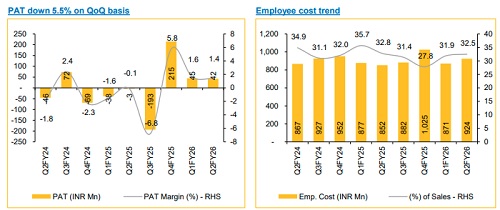

* PAT for Q2FY26 came in at INR 42 Mn (vs CIE est. INR 71 Mn). PAT margin improved 160bps YoY, reaching 1.5% (vs CIE est. 2.3%)

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131