Reduce HDB Financial Services Ltd Ltd For Target Rs. 740 By JM Financial Services

Weak quarter; downgrade to Reduce

HDB Financial Services reported 11% miss in PAT (-2%/+2% YoY/QoQ) on account of higher than expected credit costs of ~2.7% (vs. 2.3% JMFe) as asset quality trends were negatively impacted by CV/CE. PPoP was in line with our estimates (+24%/+9% YoY/QoQ) led by +21bps expansion in NIMs (calc.) (7.9% in Q2FY26). Disbursements were muted (down 1% YoY) leading to further moderation in AUM YoY growth to 13% in 2QFY26. Management guided NIMs of ~7.9-8.0%, AUM growth of 18-20% CAGR 26 and credit costs of 2.2% over the medium term post-FY. We believe despite a strong franchise, HDB stands inferior among diversified peers in terms of AUM growth (~12% CAGR over FY25-27E) and returns profile (avg RoA/RoE of 2.2%/14% in FY26/27E) vs. CIFC (AUM CAGR/avg RoA/RoE of 19%/2.5%/20%) and BAF (~24% AUM CAGR/ avg RoA/RoE of 24%/4.0%/20%) over FY25-27E. We have cut our FY26-28E EPS by ~3%-7% leading to cut in TP to INR740 (INR780 earlier), valuing it at 2.6xFY27E P/B. We change our rating from HOLD to REDUCE to align with our new rating system.

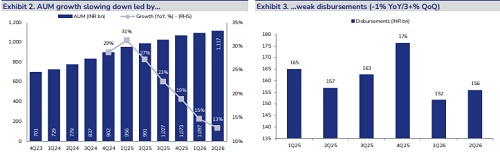

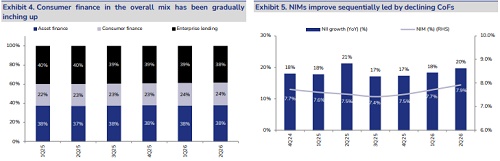

Moderation AUM growth led by weak disbursals: Weak disbursements growth (-1%/+3% YoY/QoQ), resulted in subdued AUM growth of +13%/+2% YoY/QoQ (broadly in-line with JMFe) with mixed trends across segments. While asset finance and enterprise lending posted a sequential disbursement growth of ~14%/10%, consumer finance declined by ~9% QoQ. Overall AUM growth therefore moderated with asset finance/consumer finance/enterprise lending posting weak sequential growths of 2%/2%/1% respectively. Share of consumer finance in the overall mix has been gradually inching up and management hopes to continue in that trajectory. Going into 2H, management expects growth to pick up led by key policy initiatives such as the GST rationalization exercise and rate cuts, along with a good monsoon, and a strong festive season etc. Management has guided for a medium term AUM growth of ~18-20% CAGR.

In-line operating performance: HDB reported an inline PPoP of INR 15.3bn (+24%/+9% YoY/QoQ). NII growth was strong at +20%/+5% YoY/QoQ (-4% JMFe), supported by a 21bps QoQ expansion in NIMs to 7.9%, driven by a 34bps QoQ decline in CoFs. This was offset by lower than expected opex of INR 13.2bn (-6% JMFe). However PAT was a substantial miss (-11% JMFe) led by elevated credit costs of 2.7% (vs. 2.3% JMFe). RoA (calc.) for 2Q stood at ~1.9%. Adjusting for IPO-money RoA stood at ~2% for the quarter. We revise our NIM (calc.) assumptions downward (-10bps) to 7.8%/8.1% for FY26E/FY27E, driving average RoA/RoE of 2.3%/14% over the same period.

Asset quality deteriorates: GS3/NS3 rose sequentially to 2.8%/1.3% (+25bps/+17bps QoQ) on account of higher slippages in the CV/CE segments primarily due to seasonal factors such as floods in Assam and other northern regions, which impacted utilization levels in Jul/Aug. Stage-3 PCR declined 196bps QoQ to 54.7%. However overall ECL cover was steady QoQ at ~3.3%. We expect credit costs to decline gradually, and thus build in an average credit cost of ~2.4% over 2HFY26, and then decline further to ~2.2% by FY27 in-line with management guidance.

Valuation and View: We believe that despite a strong franchise, HDBFS stands inferior among diversified peers in terms of AUM growth (12% CAGR over FY25-27E) and returns profile (avg RoA/RoE of 2.3%/14%) vs CIFC (AUM CAGR/avg RoA/RoE of 19%/2.5%/20%) and BAF (24% AUM CAGR/ avg RoA/RoE of 24%/4.1%/21%) over FY25-27E. Thus, we do not expect material upside in HDBFS from here on given its limited visibility on growth/RoE, and assign REDUCE rating (as per our new rating system) with TP of INR 740, valuing it with an unchanged target multiple of 2.6x FY27E P/BV.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)