Buy Jeena Sikho Lifecare Ltd for the Target Rs. 900 by Choice Institutional Equities

Business Overview:

JSLL, headquartered in Zirakpur, Punjab, is a leading provider of Ayurvedic healthcare services and products, focussed on delivering affordable, high-quality and holistic treatment. The company has built a strong pan-India presence with a strong network of 50 hospitals and 65 clinics and day-care centres with 330+ Ayurvedic medicines & wellness products. Its primary healthcare facilities function under the name Shuddhi Ayurveda Panchakarma Hospital (HIIMS), focusing on the treatment of various health conditions including cancer, diabetes, liver disorders, arthritis, high cholesterol, thyroid issues and joint pain.

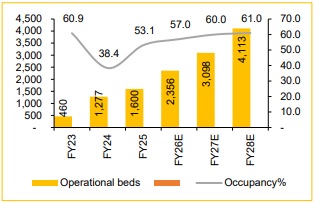

Is JSLL’s strategic bed expansion poised to drive long-term growth?

JSLL expanded its operational bed capacity to 2,570 beds, with a clear roadmap to scale to 7,000–10,000 beds in 3–5 years. Recent tie-ups with Ayurveda colleges (Mohali, Vrindavan, Aurangabad) provide low-CAPEX access to new facilities, accelerating growth without straining capital. Occupancy rates have also improved and management expects steady gains as new hospitals mature. Given India’s large unmet demand for alternative healthcare, JSLL’s expansion positions it to capture both domestic and international patient bases.

Could product launch transform the OTC JSLL’s revenue mix?

The launch of JSLL’s OTC range, starting with the PET Liver-Spleen Shuddhi Kit, has seen strong initial traction, with 2,200 orders in the first hour. With plans to introduce 15+ products (covering BP, sugar, kidney, liver, anxiety and sexual wellness), the management targets INR 500Cr OTC turnover in 1.5–2 years. The OTC vertical offers high margins (~85% gross, ~20% PAT after distribution) and complements hospitals by cross-referring patients. If successful, OTC can diversify revenues beyond hospital services, creating a scalable consumer health brand.

Could JSLL sustain its exceptional profit margin amid rapid expansion?

JSLL delivered 45% EBITDA Margin in Q1FY26, supported by high-margin Panchakarma services and rising patient volumes. While expansion typically pressures margin, JSLL offsets this with scale benefits, strong occupancy and cross-subsidisation strategies (e.g., offering 10% free treatment for weaker sections to reduce ad-spends via word of mouth). The management guides for maintaining a a 20–25% PAT margin even as hospital beds and OTC products expand aggressively. With operational efficiency and low-cost hospital tie-ups, profitability is expected to remain resilient.

Will international expansion boost JSLL’s brand and earnings?

JSLL has set up clinics in Dubai and Abu Dhabi, with plans for 4 more in the UAE and early success in Nepal, which generated profits in its first quarter. This international foray positions JSLL as a global Ayurveda brand, catering to the rising demand for natural healthcare abroad. With India’s Ayurveda industry gaining government backing under “Vocal for Local” and “Make in India,” JSLL is well-placed to capture diaspora and wellness tourism markets.

Why invest in JSLL?

Investing in JSLL offers exposure to India’s fast-growing Ayurveda and alternative healthcare sector. JSLL has scaled up its healthcare presence to 2,570 operational beds across 100+ cities, with plans to expand to 7,000–10,000 beds in 3–5 years. Additionally, its OTC Ayurvedic products pipeline targets a INR 500Cr market in the next two years, supported by clinical trials and pan-India distribution. With proven execution, diversified growth drivers (hospitals + products) and robust demand for natural healthcare, JSLL presents a compelling long-term investment opportunity.

Recommendation:

We currently have a ‘BUY’ rating on the stock with a target price of INR 900.

Key Risks:

* Key-man risk: As the founder and driving force behind JSLL, Mr. Manish Grover is deeply involved in operations, strategy, brand and vision. Any disruption to his leadership could impact decision-making, culture or stakeholder trust,

* Consumer complaints: JSLL may face consumer complaints and lawsuits over defective products or treatment-related injuries, damaging reputation and confidence.

Operating beds to increase by ~2,500 beds in 3 years

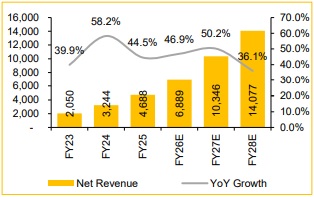

Revenue expected to grow at ~44% CAGR (FY25-28E)

Despite expansion, EBITDA margin to improve annually

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)