Buy Gujarat Gas Ltd for the Target Rs. 535 by Motilal Oswal Financial Services Ltd

Commentary cautious; focus on margin expansion

* Gujarat Gas (GUJGA)’s EBITDA margin stood above our est. at INR5.4/scm (our est. INR5/scm). Volumes came in line with our est. at 9.3mmscmd (our est. 9.25mmscmd). While GUJGA’s realization increased ~INR1.3/scm QoQ, gas cost decreased INR0.4/scm QoQ and opex increased 0.8/scm QoQ, leading to ~INR1/scm QoQ increase in EBITDA/scm margin. Resultant EBITDA came in 8% above our est. at INR4.5b. Due to higher-than-estimated other income, PAT came in 24% above our est. at INR2.9b.

* About 35%/25% of GUJGA’s gas sourced in 4Q is under long-term (fully Brent-linked)/spot contracts. Lower crude oil and spot LNG prices, coupled with INR appreciation QoQ, are expected to reduce gas costs going forward. While Morbi volumes are expected to remain soft in the near term, management expects robust 12% YoY growth in CNG volumes. Further, rising industrial volumes from Thane and rural Ahmedabad are also likely to support volume growth.

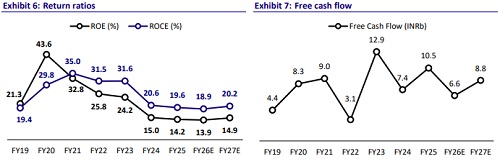

* GUJGA currently trades at 22x FY27E P/E. We reiterate our BUY rating on the stock with a TP of INR535, valuing it at 25x FY27E EPS.

EBITDA margin guidance maintained; 1Q Morbi volumes under pressure

* Amid lingering uncertainties around APM deallocation and lowering propane prices, management maintained its EBITDA margin guidance of INR4.5- INR5.5 per scm. However, with decreasing crude prices and spot LNG prices, we believe that management’s guidance is conservative. We are building in EBITDA/scm of INR5.6/5.8 per scm for FY26/27.

* In 4Q, average Morbi volumes stood at 2.87mmscmd (3.35mmscmd in 3QFY25). The decline in Morbi volumes was due to customers shifting to alternate fuels. Non-Morbi volumes were slightly up QoQ at 2.16mmscmd (2.1mmscmd in 3Q). With the current propane to Natural Gas (NG) price delta at INR3.5/scm, current Morbi volumes remain soft at 2.6-2.7mmscmd. Management anticipates similar I/C PNG volumes QoQ in 1Q. Further, it expects robust 12% YoY growth in CNG volumes in FY26.

Other key takeaways from the conference call

* In 4QFY25, gas sourcing split for total volumes was 25%/35%/25%/15% of APM/Brent-linked LT/Spot LNG/other ST contracted gas.

* New LT contracts (both HH and Brent linked) at competitive pricing are expected to be signed shortly. Current APM/NW gas allocation stands at 2/0.6mmscmd.

* Management maintained its FY26 capex guidance of INR10b.

* GSPC clocked volumes of ~13mmscmd in 9MFY25.

* Under the F-DODO scheme, 70+ CNG stations are expected to come online in FY26.

* The Scheme of Amalgamation and Merger is expected to be completed by Sep’25/Oct’25. The scheme was filed with MCA for approval in Feb’25.

Beat driven by higher-than-estimated EBITDA/scm margin

* Total volumes were in line with our estimate at 9.3mmscmd (our est.: 9.25mmscmd) (-4% YoY).

* While I/C-PNG volumes were marginally below estimates, D-PNG volumes came in 16% above estimates.

* EBITDA/scm came in 8% above our est. at INR5.4.

* Realization increased ~INR1.3/scm QoQ, gas cost decreased INR0.4/scm QoQ, and opex increased INR0.8/scm QoQ, leading to ~INR1/scm QoQ increase in EBITDA/scm margin.

* Resultant EBITDA stood 8% above our estimate at INR4.5b (-24% YoY).

* GUJGA’s PAT came in 24% above our est. at INR2.9b (-9% YoY), driven by higherthan-estimated other income.

* In FY25, GUJGA’s net sales/EBITDA/APAT were flat YoY at INR165b/18.8b/11.5b.

* The Board has recommended a final dividend of INR5.82/sh (FV: INR2/sh).

Valuation and view

* The company’s long-term volume growth prospects remain robust, with the addition of new industrial units and expansion of existing units. It is aggressively investing in infrastructure to push industrial gas adoption in Thane rural, Ahmedabad rural, and newly acquired areas in Rajasthan.

* The stock is trading at a P/E of 22x FY27E and EV/EBITDA of 13x for FY27E. We reiterate our BUY rating on the stock with a TP of INR535, valuing it at 25x FY27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412