Buy Apollo Tyres Ltd for the Target Rs. 554 by Motilal Oswal Financial Services Ltd

Underperforms peers

Corrective measures in place to normalize performance

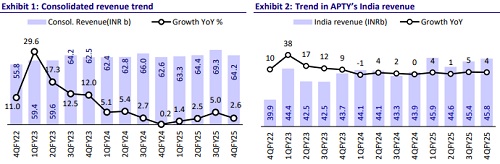

* APTY’s 4QFY25 earnings, although in line with our estimates, have been below par compared with peers. Consolidated PAT (adjusted for one-offs) declined 42% YoY to INR2.7b (in line) due to a 420bp decline in EBITDA margin to 13% (in line). APTY is implementing corrective measures to address its underperformance and is confident of improving its performance from 1QFY26 onward.

* After a weak performance in FY25, which was largely impacted by a sharp rise in input costs, we expect APTY’s margins to gradually revive, aided by softening costs and its focus on premiumization. We have factored in a 130bp expansion in APTY’s margins over our forecast period, driving a 25% PAT CAGR over a corrected base. Valuations at 15.6x FY27E appear attractive, especially when compared to peers. We reiterate our BUY rating on APTY with a TP of INR554 (valued at 18x FY27E consol. EPS).

APTY underperforms peers in 4Q

* APTY’s 4Q earnings, although in line with our estimates, came in below par compared with peers.

* Consolidated PAT (adjusted for one-offs) declined 42% YoY to INR2.7b (in line) due to a 420bp decline in EBITDA margin to 13% (in line).

* Standalone Revenue grew 4% YoY to INR45.8b, trailing its peers’ growth.

* Its underperformance has been attributed to its exit from few SKUs, both in OEM and exports.

* Gross margins improved 110bp QoQ due to a reduction in input costs.

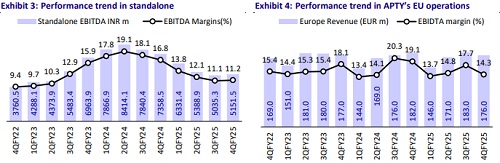

* However, higher other expenses continued to drag down performance as its margins remained largely stable QoQ at 11.2%, compared with healthy margin expansion reported by peers.

* As a result, standalone earnings declined 10% YoY to INR 1.4bn (in line).

* APTY underperformed peers even in Europe and posted a 4% YoY decline in revenue to EUR176m. Europe margins declined 440bp YoY to 14.3% due to a 7% rise in input costs and weak demand.

* For FY25, the consolidated entity posted a 33% YoY decline in earnings largely due to a 400bp reduction in margin to 13.7%. Margin remained under pressure due to rising input costs.

* Similarly, the standalone entity posted a 45% YoY decline in earnings due to a 560bp decline in margins to 12.1%.

* At Europe manufacturing operations, EBITDA margin declined 170bp YoY to 15.2% largely due to supply constraints and rising input cost pressure.

* For FY25, APTY delivered FCF of INR10.9b after a capex of INR7.3b.

* APTY has declared a dividend of INR5 per share, translating into a dividend payout of 28%

Highlights from the management commentary

* Management admitted that APTY’s performance was below par compared with peers and weaker than their own expectations. The company is implementing corrective measures to address this and is confident of improving its performance from 1QFY26 onward.

* On input costs, while they are expected to decline in the coming quarters, management expects the raw material basket to remain stable QoQ in 1QFY26. From 2Q onward, benefits of a reduction in crude-led derivatives are likely to reflect in financials. However, management believes that prices of natural rubber may not come down soon as we will shortly enter the lean period for rubber (rainy season).

* APTY’s exposure to the US market is currently around USD100m in revenues and hence, to that extent, it would see a limited impact of changes in tariff regulations in the region.

* APTY has recently announced its intention to shut production at its Netherlands plant by 2026. This plant had a capacity of 0.5m PCR tyres out of the 6mn tyres produced in Europe. It has started the regulatory procedure around this and is likely to proceed with the plan once all approvals are in place, which is likely to take a few quarters. APTY does not expect any material revenue loss due to this closure as it expects the deficit in supply to be filled up from the upcoming capacities in Hungary and India. Further, given that conversion costs in Hungary are almost 1/3rd of costs in the Netherlands, APTY expects its operational performance to structurally improve in the coming years in Europe.

Valuation and view

* APTY has underperformed peers in FY25. However, it is implementing corrective measures to address this and is confident of improving its performance from 1QFY26 onward.

* After a weak performance in FY25, which was largely impacted by a sharp rise in input costs, we expect APTY’s margins to gradually revive, aided by softening costs and its focus on premiumization. We have factored in APTY’s margins to improve by 130bp over our forecast period, driving a 25% PAT CAGR over a corrected base. Valuations at 15.6x FY27E appear attractive, especially when compared to peers. We reiterate our BUY rating on APTY with a TP of INR554 (valued at 18x FY27E consol. EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Ltd.jpg)