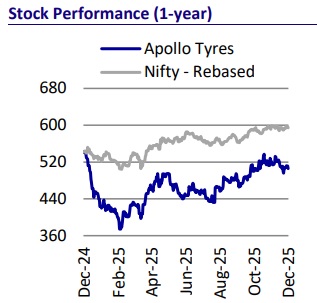

Buy Apollo Tyres Ltd for the Target Rs. 600 by Motilal Oswal Financial Services Ltd

Healthy demand in India; margin turnaround expected in EU

We met Apollo Tyres’ (APTY) management to understand the outlook for its key segments. Demand in India across most key segments remained healthy in 3Q, both in replacement and OEM. While this momentum is likely to sustain in 4Q, the outlook for the CV segment remains uncertain. Further, exports demand remained strong in 3Q and is likely to sustain in 4Q as well. However, margins are likely to remain under pressure in India in 2H due to increased promotional spending. While demand in Europe remains muted, APTY continues to outperform the market over a low base. Additionally, APTY has commenced the restructuring of its Enschede facility, the benefits of which are likely to be reflected from 2HFY27E. We factor in APTY to post a 22% earnings CAGR over FY25- 28E over a corrected base. Valuations at 16.3x/14.3 FY27E/FY28E appear attractive, especially when compared to those of peers. We reiterate our BUY rating on APTY with a TP of INR600 (valued at 18x Sep’27E consol. EPS).

India business outlook

Demand for PVs, 2Ws, and LCVs is strong and likely to remain healthy going forward. However, it is still unclear whether CV demand will sustain in 4Q and beyond. Export volumes continue to post double-digit growth, with momentum expected to persist in 3Q and 4Q. While input costs were expected to decline QoQ earlier, given the currency depreciation and the cyclone in Thailand, they are now likely to remain stable. Further, APTY’s appointment as the main sponsor of the Indian cricket team, with benefits expected to be back-ended, is likely to cap margin upside in the near term.

Europe business outlook

The European market remains soft amid declining industry demand. While October showed some growth, November demand was weak. 3Q is expected to deliver sequential strength due to seasonality; however, core market momentum remains muted. FY26 is expected to be a transition year in Europe, which would involve the shutdown of its Enschede facility and the shifting of certain operations to India, including up to 15-inch Vredestein tyres, some agri capacity from the Enschede plant, and CV tyres capacity from the Hungary plant. While transitory costs are expected over the next six months, cost benefits should begin to flow in partially from 2HFY27 and fully in FY28E.

Valuation and view

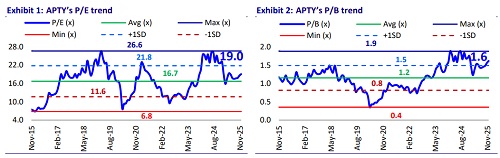

While demand in India remains upbeat, it continues to be muted in Europe. On the other hand, its promotional spends are likely to cap margin upside in India, in the near term. The restructuring at Enschede is also expected to drive margin benefits from 2HFY27 onwards. As such, we factor in APTY to post a 22% earnings CAGR over FY25-28E over a corrected base. Valuations at 16.3x/14.3 FY27E/FY28E appear attractive, especially when compared to those of peers. We reiterate our BUY rating on APTY with a TP of INR600 (valued at 18x Sep’27E consol. EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412