Buy Marico Ltd For Target Rs.775 by Motilal Oswal Financial Services Ltd

Robust revenue growth; miss on margins

* Marico (MRCO) reported consol. revenue growth of 15% YoY (in line) in 3QFY25. Domestic revenue growth was 17% YoY, with 6% volume growth. International growth was 10% YoY (16% cc growth).

* Domestic revenue was driven by strong core category growth and new business expansion. Parachute coconut oil (PCNO) posted 15% YoY value growth and 3% volume growth despite a 1% grammage reduction in the key price-point pack. The growth was driven by a price hike taken during the year. A ~5% price increase was also implemented at the quarter's end. PCNO  gained 140bp market share. VAHO revenue was down 2% YoY, affected by persistent weakness in the mass segment. Saffola oil clocked low single digit volume growth, with revenue growing 24% YoY as the pricing cycle turned favorable after two years. Foods sustained strong growth of 31% YoY. Premium Personal Care sustained its healthy growth trajectory.

gained 140bp market share. VAHO revenue was down 2% YoY, affected by persistent weakness in the mass segment. Saffola oil clocked low single digit volume growth, with revenue growing 24% YoY as the pricing cycle turned favorable after two years. Foods sustained strong growth of 31% YoY. Premium Personal Care sustained its healthy growth trajectory.

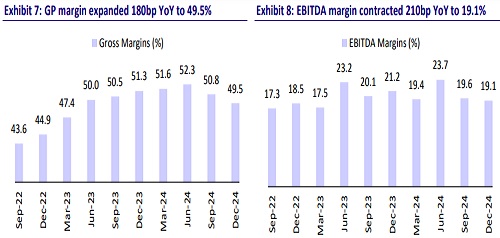

* Gross margin contracted 180bp YoY to 49.5%. EBITDA margin dipped 210bp YoY to 19.1%. EBITDA grew 4% (miss). We model EBITDA margins of 20.2% for FY25 and 20.7% for FY26.

* The company expects double-digit revenue growth (unlike other FMCG peers) in the medium term, driven by pricing, expanded direct reach, and strong performance in Foods and Premium Personal Care. While rising input costs may impact near-term margins, the long-term outlook remains positive, supported by a favorable product mix and premiumization. We reiterate our BUY rating on the stock with a TP of INR775 (based on 50x Dec’26E EPS).

In-line revenue; miss on margins

* Volume growth at 6%: Consolidated net sales grew 15% YoY to INR27.9b (in line) in 3QFY25. Domestic revenue growth was 17% YoY and volume growth stood at 6% YoY (est. 6%).

* International up 16% in CC terms: International business delivered 16% CC growth, led by Bangladesh/MENA/South Africa, which posted 20%/ 35%/17% CC growth, while Vietnam saw a 1% CC decline.

* Contraction in margins: Consolidated gross margin contracted 180bp YoY to 49.5% (est. 50.3%). Copra prices surged by 44% YoY and rice bran oil prices were up 27% YoY in 3QFY25. Crude oil derivatives remained range-bound. Commodity prices are expected to remain elevated in the near term. Employee expenses were up 10% YoY, ad spends were up 19% YoY, and other expenses were also up 19% YoY. EBITDA margin contracted 210bp YoY to 19.1% in 3QFY25 (est. 20.8%).

* Miss on profitability: EBITDA/ PBT/Adj. PAT grew 4%/5%/4% YoY to INR5.3b/INR5.2b/INR4.0b/ (est. INR5.8b/5.7/INR4.3b).

* In 9MFY25, net sales, EBITDA, and APAT grew 10%/6%/10%, respectively.

Highlights from the management commentary

* The FMCG sector maintained steady demand momentum during the quarter, with urban sentiment remaining stable and rural demand sustaining its relatively stronger growth.

* Price increases were implemented across core portfolios in response to the sharp escalation in input costs.

* Modern Trade (MT) and E-commerce, including Quick Commerce, led growth with high double-digit volume increases, while General Trade (GT) was flattish.

* In the domestic revenue mix, organized channels contribute ~30%, CSD accounts for 6-7%, and General Trade (GT) makes up 63-64%. Profitability is higher in General Trade than in organized channels.

* Project SETU was extended to one more state during the quarter, bringing the total coverage to 11 states.

Valuation and view

* We cut our EPS estimates by 2% each for FY25 and FY26.

* The improvement in market share gain, accelerated growth in Foods and Premium Personal Care, healthy growth in the International business, and the normalization of prices should help MRCO deliver a better revenue print in FY25-26.

* To improve its distribution reach, MRCO has also started Project SETU, which helps drive growth in GT through a transformative expansion of its direct reach.

* We model 11%/13% revenue and EBITDA CAGR during FY25-27E and reiterate our BUY rating on the stock with a TP of INR775 (based on 50x Dec’26E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)