Neutral Clean Science & Technology Ltd for the Target Rs. 960 by Motilal Oswal Financial Services Ltd

Muted performance due to demand weakness in key segments

Operating performance below estimates

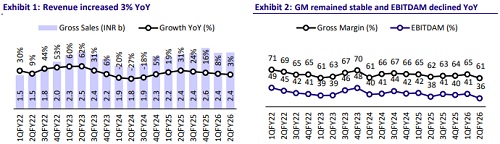

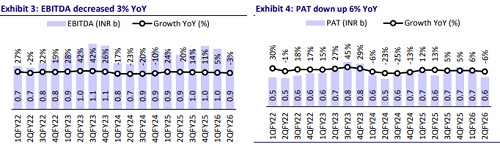

* Clean Science (CLEAN) reported EBITDA of INR871m, down 3% YoY and below our estimate of INR977m, as gross margin contracted to 60.7% (vs. 62.7% in 2QFY25) and EBITDAM contracted to 35.6% (vs. 37.7% in 2QFY25).

* While the established product portfolio witnessed demand softness in 2QFY26, this trend is expected to persist in the near term, driven by evolving market dynamics in China, deferred procurement by key customers, and demand uncertainty across end-user industries following the imposition of US tariffs.

* Factoring in the weak operating performance in 2QFY26 and the demand softness going ahead, we cut our earnings estimates for FY26/FY27/FY28 by 16%/18%/15% and value the stock at 30x FY27E EPS to arrive at our TP of INR960. Reiterate Neutral.

Performance chemical drives revenue growth

* The company reported revenue of INR2.4b, up 3% YoY (est. in line), while Performance Chemicals’ revenue grew ~13% YoY to INR1.9b. Revenue for Pharma & Agro Intermediates/FMCG Chemicals declined ~9%/~45% YoY to INR391m/INR196m.

* Gross margin stood at 60.7% (compared to 62.4%), while EBITDA margin contracted 110bp.

* EBITDA declined 3% YoY to INR871m, below our estimate of INR977m.

* Adj. PAT stood at INR554m (down 21% YoY) in 2QFY26, below our estimate of INR668m.

* In 1HFY26, revenue/EBITDA/Adj.PAT grew 5%/1%/1% to INR4.9b/INR1.9b/INR1.3b.

Highlights from the management commentary

* Macro environment: The broader operating backdrop remains challenging, shaped by uncertain demand in end-markets, aggressive pricing behavior from Chinese suppliers, evolving tariff structures, and global supply chain adjustments.

* China: The Chinese market, contributing 25-30% of revenue, remains challenging and unpredictable. Intense local competition led to deferred customer procurement. One of the company’s FMCG products in China was impacted as a key customer may have undertaken backward integration, potentially leading to a permanent volume loss.

* New projects: The company’s Project 1 (Performance Chemical) is currently undergoing chemical trials with satisfactory results, and commercialization is expected to be announced shortly. The product offers strong synergies with existing offerings through cross-selling opportunities and backward integration. The installed capacity stands at 10,000 tons, with full-scale revenue potential of around INR3b by FY28.

Valuation and view

* We expect short-term headwinds to continue, with volumes likely to be affected by global demand softness, uncertainty in end markets affecting customer purchasing behavior, and reduced procurement due to competitive pricing pressure.

* The ramp-up of the advanced grade HALS, along with the commissioning of Performance Chemical 1 and Performance Chemical 2, is expected to be a key mid-term growth driver.

* Factoring in the weak operating performance in 2QFY26 and demand softness going ahead, we cut our earnings estimates for FY26/FY27/FY28 by 16%/18%/15% and value the stock at 30x FY27E EPS to arrive at our TP of INR960. Reiterate Neutral.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412