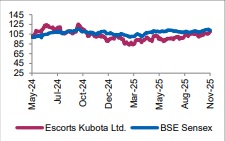

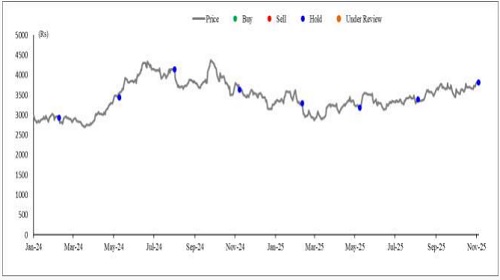

Hold Escorts Kubota Ltd Ltd For the Target Rs.3,590 by Axis Securities Ltd

Structural Levers in Place; Near-Term Upside Capped

Est. Vs. Actual for Q2FY26: Revenue – INLINE ; EBITDA – INLINE ; PAT – INLINE

Change in Estimates post Q2FY26

FY26E/FY27E: Revenue: 4.7%/5.5%; EBITDA: 11.3%/12.8%; PAT: 11.5%/13.4%.

Recommendation Rationale

* Agri Machinery & Non-Tractor Business: Strong Growth and Margin Expansion: The Agri Machinery segment delivered strong performance with revenues rising 29.1% YoY to Rs 2,432 Cr, supported by strong demand and a favorable product mix. Segmental EBIT margins expanded by 368 bps YoY to 12.8% (vs. 9.1% in Q2FY25), driven primarily by a higher contribution from non-tractor verticals, which now account for ~17% of segmental revenue. Within non-tractor offerings, the Agri Solutions division particularly harvesters was the key growth catalyst, witnessing strong traction and zero inventory levels. The product mix shift towards high-value harvesters (Rs 20–25 Lc per unit, ~4–5x the price of a tractor) proved margin accretive. Furthermore, localization of critical harvester components (such as hydraulic lifts and transmission systems) is underway, with planned exports to Japan and Thailand through Kubota’s global network

* Export Segment - Excellent Growth; Limited Immediate Impact: Export volumes increased 26.2% YoY to 1,548 tractors, supported by improved traction in Europe and Mexico. Approximately 52% of total exports were routed through Kubota’s global distribution network, enhancing market reach and operational synergies. Management remains optimistic, targeting >25% growth in FY26, with medium-term upside expected post commissioning of the greenfield capacity (FY28–29). This facility will serve as a global sourcing hub, enabling entry into the US market and production of select Kubota global models from India, positioning Escorts Kubota as a key manufacturing base within Kubota’s global supply chain.

* Construction Equipment (CE) Segment: Temporary Margin Pressure; Recovery Expected in H2: The Construction Equipment segment witnessed a volume decline to 1,146 units (vs. 1,315 units YoY), impacted by an overall industry contraction (~4%) and the transition to new emission norms. Segmental EBIT margin contracted to 3.8% (vs. 9.3% YoY), primarily due to the clearance of old-emission inventory and lower production levels, impacting fixed-cost absorption. Management anticipates a margin recovery to high single digits in H2FY26, supported by volume normalization, input cost deflation, and operating leverage benefits.

Sector Outlook: Cautiously Positive

Company Outlook & Guidance: As per management, Escorts Kubota is structurally transforming through strategic product introductions, export-led diversification, Kubota synergy benefits, and reinvestment of capital from RED divestment. These levers are expected to materialise only gradually over the next 4–6 quarters.

Current Valuation: 26x FY28 EPS (earlier Same).

Current TP: Rs 3,590/share (Earlier TP: Rs 3,135/share)

Recommendation: We continue to maintain our HOLD rating on the stock.

Financial Performance: Escorts Kubota Ltd. (Escorts) reported revenue of Rs 2,792 Cr in Q2FY26, up 23% YoY and 12% QoQ, largely in line with expectations. EBITDA stood at Rs 360 Cr, inline with expectations; up 56%/12% YoY/QoQ. EBITDA margin came in at 12.9%, up 279 bps YoY and 3 bps QoQ, supported by lower other expenses and cost optimisation efforts. Adjusted PAT stood at ~Rs 318 Cr, inline with expectation, broadly tracking the EBITDA performance and higher other income.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633