Buy Safari Industries Ltd for the Target Rs. 2,700 by Motilal Oswal Financial Services Ltd

Consistent performance; volume rises 16% YoY

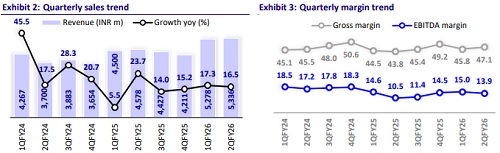

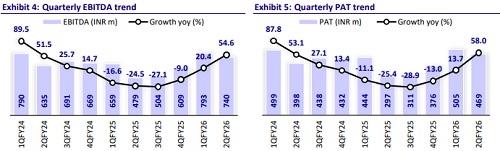

Safari Industries (Safari)’s 2QFY26 print came in above our estimate; revenue grew 16.5% to INR5.3b, supported by ~16% YoY volume growth. Its EBITDA/PAT grew 54.6%/ 58.0% YoY. Though sales in Jul and Aug’25 were lower, Sep’25 sales topped on account of Big Billion Day (BBD) sales, while sales were comparatively down. Higher growth was attributed to 1) ~10-12% growth in the e-com channel despite the high base, and 2) a pickup in the MT channel. Management expects a healthy uptick in 2HFY25 due to the strong wedding/festive season. We note Safari’s revenue momentum to continue ahead of the industry, led by 1) full utilization of the Jaipur plant (currently ~70%), 2) EBO expansion of 4-5 stores every month, and 3) DD growth in MT/E-com ~65% sales, followed by the GT channel showing a demand uptick in T2/T3 towns.

Industry-leading growth due to higher volumes in BBD sales

Safari’s revenue grew 16.5% YoY to INR5.3b in Q2FY26, backed by solid ~16% YoY volume growth. Sep’25 saw a strong pickup driven by BBD sales, while Jul and Aug were impacted. Retail, EBO, and CSD channels posted 15-17% growth, while e-commerce (contributing ~50% of sales) grew 12% on a high base. Modern Trade (MT), which now forms ~20% of sales, was the fastest-growing channel during 2Q. We expect Safari’s revenue momentum to continue to be ahead of the industry, led by 1) ~75% contribution from hard luggage, 2) rising consumer traction through NPD, 3) supply support from the Jaipur unit (75% capacity utilization), and 4) higher premium sales (INR2b by FY26E). We expect the Jaipur unit to have the potential to clock revenues of INR10b at full capacity utilization. With increased back-end manufacturing at Jaipur, management remains upbeat about revenue growth momentum, with ~14-15% volume growth expected for the next 3-5 years.

RM softness and backward integration drive margins

In 2Q, gross margin improved 322bp to 47.1% YoY and 129bp QoQ due to 1) lower discounting in the fast-growing e-com & MT channel, 2) RM prices softening, and 3) value engineering. EBITDA grew by 54.6% to INR740m, settling EBITDA margin at 13.9% (+342bp YoY), while EBIT grew by 70.0% to INR565m despite higher depreciation (+19.6%). PAT grew by 58.0% to INR469m despite lower other income (-18.4%) and lower interest cost (-13.2%). With better revenues in 2HFY26, we expect further margin improvement.

Valuation and view: Reiterate BUY

We expect Safari to deliver industry-beating growth and expand its market share by focusing on 1) building the Urban Jungle brand along with SI-Select (premium positioning), 2) ramping up capacity utilization at Jaipur, 3) developing in-house manufacturing of ancillary components, and 4) adding 4-5 EBOs every month. Though we are confident about Safari’s growth story, we expect rising competitive intensity from VIP and Samsonite, as well as from local players in the soft luggage market, may dent Safari’s growth rates. However, led by its strong operating performance in 2QFY26, we reiterate our BUY rating with a DCF-based TP of INR2,700 (based on an implied P/E of 50x on Sep’27). Key risks: delayed capacity expansion and sudden rise/discounting by regional competition (refer to our IC note dated Sep’25).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412