Buy JK Lakshmi Cement Ltd for the Target Rs. 1,100 by Motilal Oswal Financial Services Ltd

Operating performance in line; Durg expansion on track

FY30 capacity target of 30mtpa maintained

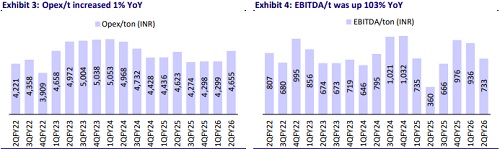

* JK Lakshmi Cement (JKLC)’s 2QFY26 EBITDA was in line with our estimates at INR2.1b (+133% YoY, albeit on a low base) as the benefit of better realization was offset by higher-than-estimated opex/t. EBITDA/t increased 103% YoY to INR733 (in line). It reported PAT of INR809m (+22% vs. estimate, led by higher other income and lower ETR) vs. a loss of INR307m in 2QFY25.

* Management indicated that demand in Oct’25 was muted due to unseasonal rains and the festival effect; however, demand is likely to recover from midNov’25. JKLC outperformed industry growth in 1HFY26. JKLC believes that the company will sustain above-industry growth in 2H as well. The company placed main plant and machinery orders for Durg expansion and expects commissioning of clinker capacity (2.3mtpa) by Mar’27 and grinding capacities (4.6mtpa) during FY27-28, in a phased manner. Post-Durg expansion, the company’s capacity will increase to 22.6mtpa.

* We broadly retain our earnings estimates for FY26-28. The stock is trading at 9x/8x FY27E/FY28E EV/EBITDA. We value the stock at 11x Sep’27E EV/EBITDA to arrive at our TP of INR1,100. Reiterate BUY.

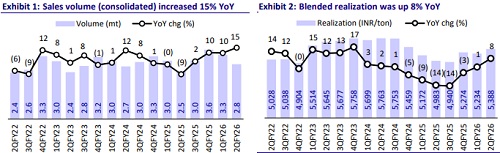

Sales volume up 15% YoY; realization/t improves 8% YoY

* Consolidated revenue/EBITDA/adj. PAT stood at INR15.3b/INR2.1b (up 24%/133% YoY and up ~9%/in line). Net profit stood at INR809m vs. a loss of INR307m in 2QFY25. Sales volume increased 15% YoY to 2.8mt. Realization/t was up 8%/3% YoY/QoQ at INR5,388/t (~5% above estimate).

* Opex/t rose 1% YoY (~5% above est.), led by a ~9% YoY rise in freight cost/t. Variable cost/other expenses per ton dipped ~2%/5% YoY. OPM surged 6.4pp YoY to ~14%; EBITDA/t rose ~103% YoY to INR733 in 2Q. Depreciation/finance costs rose ~4%/13% YoY. Other income was up ~130% YoY.

* In 1HFY26, revenue/EBITDA/Adj. PAT stood at INR32.7b/INR5.2b/INR2.3b (up ~17%/67%/275% YoY). OPM increased 4.7pp YoY to ~16%. Realization/t stood at INR5,305 (up ~4% YoY), while EBITDA/t stood at INR842 (up ~49% YoY). OCF stood at INR352m vs. INR52m in 1HFY25. Capex stood at INR252m vs. INR440m. Net cash inflow stood at INR99m vs. net cash outflow at INR388m in 1HFY25.

Highlights from the management commentary

* JKLC’s sales mix toward the North and West markets improved, which led to higher realizations. Lead distance reduced to 395km from 399km in 1QFY26. Blended cement share was ~62% vs. ~66%/63% in 2QFY25/1QFY26.

* Premium product share was at ~26% of trade volume vs. ~23% in 1QFY26. Trade sales stood at ~53% vs. ~53%/56% in 2QFY25/1QFY26.

* The company acknowledged that the INR1,000/ton full-year target remains aspirational given the current competitive environment, though efforts continue to narrow the gap with regional peers

Valuation and view

* JKLC’s 2QFY26 operating performance was in line. It has posted robust volume growth of ~15% YoY, albeit on a low base. It remains confident of sustaining volume growth above industry levels, supported by entering into newer markets where it is also adding capacity in the next one to two years. Further, the company’s realization improved QoQ, led by a better geo-mix, an increase in premium share, and higher non-cement revenue.

* We estimate a CAGR of ~10%/20%/31% in revenue/EBITDA/PAT over FY25-28 and project an EBITDA/t of INR864/INR954/INR987 in FY26E/FY27E/FY28E vs. INR718 in FY26. We further estimate its net debt will rise to INR26.4b by FY28 from INR14.2b as of Sep’25 due to the higher capex plan. The net debt-to-EBITDA ratio is estimated at 1.8x by FY28E vs 1.3x currently. The stock is trading at 9x/8x FY27E/FY28E EV/EBITDA. We value JKLC at 11x Sep’27E EV/EBITDA to arrive at our TP of INR1,100. Reiterate BUY.

.

.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412