Buy Hexaware Technologies Ltd for the Target Rs. 850 by Motilal Oswal Financial Services Ltd

Not out of the woods yet

Incremental headwinds to weigh on 4QCY25 performance

* Hexaware Technologies (HEXT) reported revenue of USD395m in 3QCY25, up 3.4% QoQ in CC terms vs. our estimate of 3.3% QoQ CC. Growth was led by Manufacturing and Consumer (up 16.5% QoQ), followed by Healthcare and Insurance (up 11.3% QoQ). Hi-Tech and PS & Travel verticals declined by 8.6%/9.8% QoQ. The reported EBIT margin stood at 14.7%, broadly in line with our estimate of 14.9%. PAT was down 2.6% QoQ/up 23.4% YoY at INR3.7b (our est. of INR3.8b).

* In INR terms, 3Q revenue/EBIT/PAT grew 11.1%/22.8%/23.4% YoY. In 4Q, we expect its revenue/EBIT/PAT to grow 9.2%/18.1%/13.1% YoY. We expect near-term softness from incremental headwinds in 4Q, though HEXT’s USD3b deal pipeline and margin discipline highlight steady execution. Visibility into CY26 should improve as client budgets are finalized by Jan’26. We reiterate our BUY rating with a TP of INR850 (based on 28x Jun’27E EPS, 30x earlier), implying a 26% potential upside.

Our view: Continued pressure in near term

* Headwinds to weigh on 4Q growth: HEXT reported 3.4% QoQ CC growth (1.7% organic) in 3QCY25, broadly in line with expectations, aided by higher license-linked revenues. We believe the demand environment is largely unchanged, and short-term challenges persist.

* US government shutdown has temporarily restricted H1-B visa transfers between employers, which we think could constrain onsite growth in the near term; this is an additional headwind and was not baked into our estimates.

* Incremental furloughs and budget constraints in select Professional Services accounts may also weigh on 4Q performance. That said, we expect visibility to improve into CY26 as client budgets close out over Dec’25-Jan’26. We expect YoY CC growth of 7.1%/7.9% in CY25E/CY26E, with organic YoY CC growth of 5.7% for each.

* Vertical momentum mixed; BFSI remains key driver: Financial Services will remain the primary growth driver, aided by new logos and deal ramp-ups. Healthcare & Insurance benefitted from license-linked revenue, while HiTech & Professional Services remained under pressure due to client-level budget cuts and slower project ramp-ups; we expect a gradual recovery over the next couple of quarters.

* Short-cycle deals returning, but yet to make a dent: We note a sequential improvement in deal activity, led by some traction in short-cycle, GCC-led, and renewal-based engagements. Two large consolidation deals were won in BFSI and Insurance. We believe the record USD3b pipeline could offer momentum in CY26, though some moderation in 4Q is likely as decisions close.

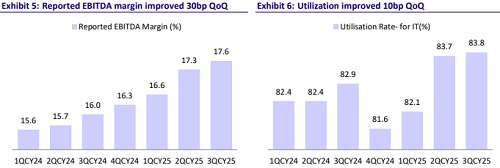

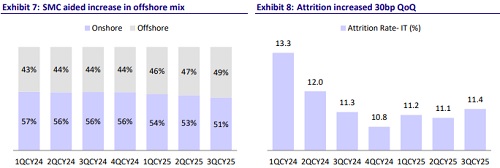

* Marginal revision to EBITDA guidance: EBITDA margin expanded 30bp QoQ to 17.5%, supported by operational efficiency and forex gains, partly offset by higher license and travel costs. Offshore mix improved to ~49%, providing structural leverage. SMC integration helped to tilt the mix to offshore, which helped in margin gains. We expect margins to stay within the revised guidance of 17.1-17.2% as the company continues to reinvest operational savings in growth. We expect EBITDA margin of 17.1%/17.9% in CY25E/CY26E.

Valuation and view

* Amid a cautious demand environment, HEXT’s execution remains steady, supported by traction in short-cycle and consolidation deals. The company is navigating transient challenges, such as furlough impact in 4Q, visa transfer restrictions and selective client budget constraints, while maintaining margin discipline within the guided band. Our estimates are broadly unchanged. We expect a PAT CAGR of 15.5% over CY25-27E. We reiterate our BUY rating with a TP of INR850 (based on 28x Jun’27E EPS), implying a 26% potential upside.

Revenue and margins in line with our estimate; Manufacturing and Healthcare led growth

* USD revenue came in at USD394.8m, up 3.4% QoQ in CC terms vs. our estimate of an increase of 3.3% QoQ CC.

* Growth was led by Manufacturing and Consumer (up 16.5% QoQ), followed by Healthcare and Insurance (up 11.3% QoQ). Hi-Tech and Professional Services & Travel and Transportation verticals declined by 8.6%/9.8% QoQ.

* In terms of geographies, Americas was up 3.7% QoQ, and Europe grew 2.4% QoQ in USD terms.

* EBITDA margin stood at 17.3% (est. 17.3%). The company revised its EBITDA guidance to 17.1-17.2% (from 17.1-17.4% earlier) after wage hikes in CY25.

* Reported EBIT margin stood at 14.7%, broadly in line with our estimate of 14.9%.

* PAT was down 2.6% QoQ/up 23.4% YoY at INR3.7b (our est. of INR3.8b).

* The headcount rose to 33,590 (up 3.6% QoQ) in 3QCY25. Attrition (LTM) increased by 30bp QoQ to 11.4%. Utilization was up 10bp QoQ at 83.8%.

* The company announced the acquisition of a 100% stake in Cybersolve to enhance its capabilities in identity access and management solutions. The company will pay USD34.5m upfront, while the remaining payment of USD31.5m is contingent on financial performance, taking the total consideration to USD66m.

Key highlights from the management commentary

* The demand environment has stabilized, with improving trends across verticals and early signs of recovery in the Manufacturing & Consumer (M&C) sector — the key drag in earlier quarters.

* Short-term headwinds emerged from the US government shutdown, restricting visa transfers (for employees moving between US employers), which could constrain onsite growth temporarily.

* Management expects CY26 to be better than CY25, supported by improved demand visibility and ongoing client budget discussions for next year. Further clarity on client spending plans is expected in 4QCY25.

* This quarter benefited from higher license revenue, which offset headwinds from a higher offshore mix and moderation in the BPO segment.

* Management guided for a flat 4QCY25, factoring in regular furloughs (~2.5-3% impact) and temporary government shutdown-related disruptions.

* Two major consolidation deals were won — one with a Canadian bank and another with a Germany-based global insurer.

* Deal momentum remains healthy across categories — short-cycle, GCC-led, and renewal-based engagements.

* Manufacturing & Consumer: Early recovery signs are visible, aided by SMC contribution. Excluding SMC, the segment still delivered positive growth. New logos were added, and the decline has largely bottomed out.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412