Buy Equitas Small Finance Bank Ltd for the Target Rs. 70 by Motilal Oswal Financial Services Ltd

High provisions drive slight earnings miss

NIMs contract by 26bp QoQ; asset quality broadly stable

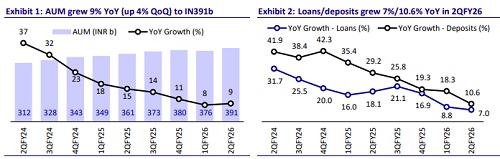

* Equitas SFB (EQUITASB) reported 2QFY26 PAT at ~INR241m (87% YoY, miss to our estimate) vs. loss of INR2.2b in 1QFY26, owing to higher-thanexpected provisions. During 2QFY26, the bank sold its NPA assets amounting to INR2.16b to an ARC.

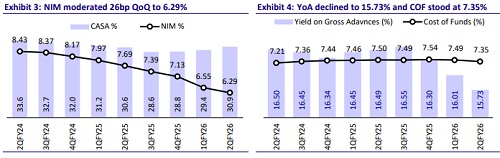

* NII declined 3.6% YoY (down 2% QoQ) to INR7.7b (4% beat). NIM contracted 26bp QoQ to 6.29% due to the cascading effect of portfolio rundown in MFI.

* Advances grew 4.6% QoQ/7% YoY. MFI portfolio declined 4% QoQ, which now stands at 8.7% of the portfolio. Meanwhile, deposits grew 11% YoY/flat QoQ. CASA ratio improved 148bp QoQ to 30.9%.

* Slippages stood at INR6b vs. INR6.6b in 1QFY26. MFI DPD showed significant improvement sequentially on account of increased collection efficiency. GNPA/NNPA ratios remained stable at 2.92%/0.98%. PCR was stable at 67%.

* We fine-tune our earnings estimates and estimate RoA/RoE of 1.0%/10.5% by FY27. Reiterate BUY with a TP of INR70 (1.3x FY27E ABV).

FY26 loan growth guided at 15%; credit cost to sustain at 1.5-1.7%

* 2QFY26 PAT stood at ~INR241m (87% YoY) vs. loss of INR2.2b in 1QFY26.

* NII declined 3.6% YoY (down 2% QoQ) to INR7.7b (4% beat). NIM contracted 26bp QoQ to 6.29%. Provisions declined 37% YoY/66% QoQ to INR2.1b (17% higher than MOFSLe).

* Other income declined 4% YoY/21.5% QoQ to INR 2.3b (6% miss). Treasury income stood at INR340m vs. INR1.2b in 1QFY26. Opex grew 10% YoY/ flat QoQ at INR7.6b (in line). Thus, PPoP stood at INR2.4b (down 31% YoY and 24% QoQ, 11% beat).

* Advances grew 7% YoY/4.6% QoQ to INR363b. MFI business declined 40% YoY/4% QoQ. HF posted healthy growth, rising 4.1% QoQ. VF loan grew by 10.4% YoY/3.1% QoQ amid growth in used CV at 7% QoQ. Deposits grew 11% YoY/flat QoQ. CASA ratio improved 148bp QoQ to 30.9%. CD ratio stood at 82%.

* Disbursements grew to INR53.8b in 2QFY26 (up 11% YoY and 53% QoQ), with MFI disbursements improving to INR6.8b vs. INR2.7b in 1QFY26 (INR9.5b in 2QFY25). The share of MFI AUM decreased to 8.7% from 9.4% in 1QFY26, and the bank has guided to maintain this mix around ~8-10% going forward.

* On the asset quality front, slippages stood at INR6b vs. INR6.6b in 1QFY26. GNPA/NNPA ratios remained stable at 2.92%/0.98%. PCR was stable at 67%. Credit cost significantly improved to 2.16% in 2QFY26 from 6.48% in 1QFY26.

Highlights from the management commentary

* MFI DPD showed significant improvement QoQ on account of increased collection efficiency. TN constitutes more than 50% of the MFI portfolio and its collection efficiency remains under control (higher than overall portfolio). Karnataka started showing improvement in collections (~8% of MFI portfolio).

* Provisions related to ARC were INR1.84b; INR400m reversed regarding ARC sale. The bank has received INR720m cash from this sale.

* For FY26, the bank expects advances growth of about 15% YoY. Beyond FY26, it expects to sustain a steady-state trajectory of ~20% growth.

* The bank expects to achieve an exit RoA of about 1% in 4QFY26 and credit cost of ~1.5-1.7% in the medium term.

* EQUITASB expects NIMs to cross ~6.5% by year end. At steady-state, it expects margins of ~6.5%-7%.

Valuation and view: Reiterate BUY with TP of INR70

EQUITASB reported a profitable quarter, compared to a loss in 1QFY26. Margins declined due to average MFI portfolio, though the bank expects NIM expansion in 3Q and 4Q. Loan book grew 4.6% QoQ due to healthy growth in used CV. However, MFI book further declined. MFI disbursements improved and the bank expects this to improve to INR10b in 3Q. On the asset quality front, GNPA/NNPA ratios were stable and slippages saw slight improvement. Credit cost is expected to taper down by 4QFY26, supported by improved collection efficiencies, and management expects that with sustained improvement in DPD metrics and disbursements, MFI is expected to move toward normal profitability by 4QFY26. We fine-tune our earnings estimates and estimate RoA/RoE of 1.0%/10.5% by FY27E. Reiterate BUY with a TP of INR70 (1.3x FY27E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)

.jpg)

Ltd.jpg)