Buy Adani Ports & SEZ Ltd for the Target Rs. 1,620 by Motilal Oswal Financial Services Ltd

Driving port leadership with strategic expansion and diversified cargo portfolio

* Adani Ports & SEZ Ltd (APSEZ) continues to solidify its position as a leader in the port and logistics sector through strategic acquisitions, operational enhancements, and ambitious expansion plans. The company holds a ~27% market share in all-India cargo and ~45% in container cargo handled in India as of Mar’25.

* APSEZ delivered a solid performance in FY25, aligning with market expectations. The company anticipates 1.5-2.0x higher growth than India’s cargo volume growth, driven by market share gains and capacity expansions. The logistics business plays a vital role in this outlook, enhancing last-mile connectivity and adding value to domestic port operations.

* Containers remain the cornerstone of APSEZ’s cargo mix, rising to 42% of total volume in FY25 from 37% in FY24. This shift highlights the company’s investment in container handling infrastructure, a primary driver of its projection of 505-515MMT cargo handling in FY26. Dry and liquid cargo also contribute to growth, with containers leading the charge. This balanced cargo portfolio, combined with capacity expansions, positions APSEZ to meet diverse market demands.

* APSEZ has earmarked INR120b for capex in FY26, including INR60b for domestic ports, INR20b for overseas projects in Colombo and Tanzania, INR6.2b for marine services, INR20b for logistics, and INR13.8b for tech and sustainability. This reflects a balanced focus on growth and operational excellence.

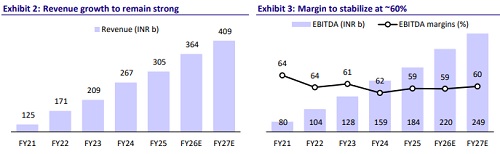

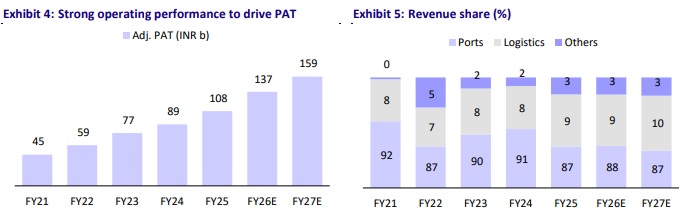

* APSEZ’s diversified cargo mix and ongoing infrastructure investments are expected to support its target of 505–515MMT cargo handling in FY26. We expect APSEZ to report 10% growth in cargo volumes over FY25-27. This would drive a CAGR of 16%/16%/21% in revenue/EBITDA/PAT over FY25-27. We reiterate our BUY rating with a TP of INR1,620 (premised on 15x FY27E EV/EBITDA).

Strategic expansion underway in domestic and international operations

* APSEZ’s expansion efforts span both domestic and international markets. In India, the company acquired Gopalpur Port and launched Vizhinjam Port, the nation’s first fully automated transshipment port, which recently handled over 0.1m TEUs in a single month.

* Globally, APSEZ began operations at Sri Lanka’s Colombo West International Terminal (CWIT), the country’s first fully automated deep-water terminal, and secured a 30-year concession for a container terminal at Dar es Salaam Port in Tanzania. Additionally, Haifa Port in Israel reported 36% YoY EBITDA growth in FY25, supported by a union agreement signed in Apr’25.

* Further, APSEZ recently acquired Abbot Point Port Holdings Pte. Ltd (APPH), which marks a pivotal step in APSEZ’s international expansion strategy. This Australian port, with its 50mtpa capacity, enhances APSEZ’s ability to handle international cargo, particularly in the Asia-Pacific region. By increasing contracted capacity and optimizing pricing, APSEZ expects to significantly enhance APPH’s financial performance, targeting a near doubling of EBITDA by FY29. This move not only diversifies APSEZ’s portfolio but also strengthens its global supply chain integration.

Transforming into a complete logistics solutions service provider

* APSEZ has significantly enhanced its logistics network by launching its first block train and increasing its rake count to 132. The company now operates 12 multimodal logistics parks (MMLPs) and has expanded its warehousing capacity to 3.1m sq. ft.

* Agri silo capacity reached 1.2MMT, with a target of 4MMT. Trucking volume grew over 200%, driven by container and bulk transport demand. These improvements bolster APSEZ’s ability to deliver seamless logistics solutions, supporting its port operations and customer needs.

Marine Business – A value-added service growth driver

* The marine business is a key growth area for APSEZ, with its fleet expanding to 115 vessels, supplemented by 46 vessels operated by Adani Harbor. The integration of subsidiaries—Ocean Sparkle, Astro, and TAHID—has progressed smoothly, enhancing operational capabilities.

* APSEZ aims to triple this segment’s size within two years, leveraging global marine projects to boost revenue and efficiency. This expansion reinforces the company’s ability to provide end-to-end maritime solutions, further strengthening its integrated service offerings.

Valuation and view

* APSEZ expanded its domestic and global footprint with new ports, terminals, and logistics infrastructure in FY25 and guided further volume and revenue growth in FY26 backed by INR120b capex.

* This would drive a CAGR of 16%/16%/21% in revenue/EBITDA/PAT over FY25- 27E. We reiterate our BUY rating with a revised TP of INR1,620 (premised on 15x FY27 EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)