Buy Ipca Laboratories Ltd for the Target Rs. 1,750 by Motilal Oswal Financial Services Ltd

DF and Institutional segments drive earningslong

Work in progress to support better growth prospects in exports

* Ipca Laboratories (IPCA) delivered better-than-expected revenue/EBITDA (3%/6% beat) for 4QFY25. However, the reported PAT was hit by the impairment of certain goodwill. Adj. PAT was 19.5% above our estimate.

* IPCA is consistently delivering above-industry growth in the domestic formulation (DF) segment through product launches as well as improving its existing brand franchise.

* The overall performance was impacted by subdued growth in exports (generics/branded) for 4QFY25.

* The pricing challenges are abating in the API segment, and it is expected to have a better outlook going forward.

* We trim our earnings estimates by 3%/4% for FY26/FY27, factoring in 1) a moderation in export markets and 2) a gradual revival in the US business. We value IPCA at 34x 12M forward earnings to arrive at our TP of INR1,750.

* We expect an 11%/18%/15% sales/EBITDA/PAT CAGR over FY25-27, led by superior execution in the DF segment, b) synergy benefits from integrating Ipca/Unichem, and c) better operating leverage. Reiterate BUY.

Improved segmental mix and operating leverage fuel profitability YoY

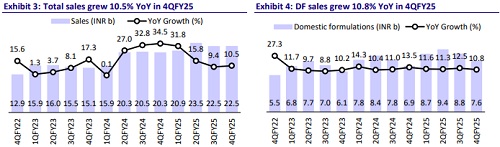

* IPCA’s 4QFY25 sales grew 10.5% YoY to INR22.4b (our est: INR21.7b).

* Formulation sales increased 11% YoY to INR12.8b (57% of sales).

* DF sales grew 10.8% YoY to INR7.6b (59% of formulation sales). Exports formulation sales grew 10.5% YoY to INR5.2b (41% of formulation sales).

* API sales grew 2% YoY to INR3.4b (15% of sales). Domestic API sales grew 18% YoY to INR906m (27% of API sales). Export API sales declined 3% YoY to INR2.5b (73% of API sales).

* Revenue from subsidiaries grew 16% YoY to INR6.1b (28% of sales). The revenue growth is largely due to Unichem.

* Gross margin (GM) expanded 220bp YoY to 68.5% due to superior product mix/lower RM costs.

* In line with gross margins, EBITDA margin expanded 330bp YoY to 19.1% (our est: 18.6%), on higher GM and better operating leverage (employee expense/other expenses down 60bp/40bp YoY as % of sales).

* EBITDA grew 33.2% YoY to INR4.2b (our est: INR4b).

* IPCA had impairment of exposure to associate (INR1.2b) and fair value of freehold land (INR860m).

* Adj. PAT grew 23.4% YoY to INR2.4b (our estimate: INR2.0b).

* Revenue/EBITDA/PAT rose 16%/32.1%/45% YoY during FY25 to INR89b/ INR17b/INR9b.

Highlights from the management commentary

* IPCA guided an 8-10% YoY growth in revenue for FY26. It also indicated a 100bp margin improvement in FY26.

* Management indicated 6-7 product filings for the US market in FY26.

* Overall, for export markets, IPCA is likely to file 20+ products in FY26.

* The generics exports business for 4QFY25 was hit by the loss of tenders in the SA market.

* Out of the capex plan of INR10b over FY25 and FY26, IPCA has incurred INR6b in FY25 and would incur INR4b in FY26.

* IPCA outperformed the DF market in acute and chronic categories in FY25.

* IPCA’s share of DF business from top-30 metro cities has increased from 32.6% in FY22 to 37.5% in FY25.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412