Neutral Escorts Kubota Ltd for the Target Rs. 3,672 by Motilal Oswal Financial Services Ltd

Margins improve but miss estimates

Tractor guidance raised, led by an improved outlook

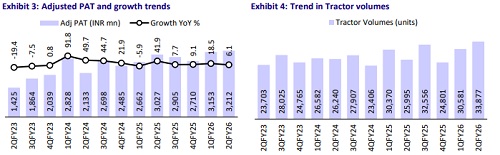

* Escorts’ 2QFY26 PAT at INR3.2b was below our estimate of INR3.7b due to a lower-than-expected margin improvement and lower other income. Both tractor and construction equipment margins were below our estimates.

* Given the improved outlook for the tractor industry after the GST rate cuts, management has raised its growth guidance for the industry for FY26E to low double digits from mid-single digits earlier. However, market share loss for Escorts over the last several quarters remains a key concern.

* Further, while synergy benefits between Escorts and Kubota are likely to materialize over the medium to long term, valuations at ~30.4x/ 27.9x FY27E/FY28E EPS appear to be already factoring in most of the positives. Hence, we reiterate our Neutral rating on the stock with a TP of INR3,672, based on ~28x Sep’27E EPS.

PAT misses our estimate due to lower-than-expected margins

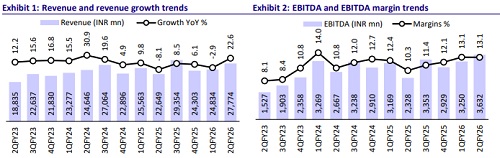

* Escorts’ 2QFY26 standalone revenue came in line at INR27.8b (est. 27.6b), growing ~23% YoY (+12% QoQ). This was mainly due to a growth of 30% YoY in tractor volumes (in line with industry growth numbers), despite a marginal dip in average realizations per unit.

* EBITDA margin improved 280bp YoY to 13.1% – lower than our estimate of 13.6%.

* While the tractor segment margin improved 370bp YoY over a low base to 12.8% (slightly below our estimate of 13%), the construction equipment segment’s margin remained under pressure. It was down 520bp YoY to 3.8% (estimate of 6%).

* Led by strong revenue growth and healthy margin improvement, EBITDA grew 56% YoY to INR3.6b (in line).

* Other income was lower than estimates at INR1.3b due to hardening of yields, which led to MTM loss on its investment book.

* Due to lower margin and lower other income, PAT missed our estimates, growing 6.1% YoY to INR3.2b (v/s estimate of 3.7b).

* Escorts’ CFO for 1HFY26 stood at INR5b, with a capex of INR1.35b. Consequently, FCF stood at INR3.65b.

* Escorts’ revenue /EBITDA/PAT rose 9.1%/25.2%/~12% YoY to INR59.5b/ INR6.9b/INR6.4b for 1HFY26. For the remainder of 2HFY26, we expect its revenue /EBITDA/PAT to grow ~3%/ 18%/38% to INR55.2b/INR7.4b/ INR7.9b.

Highlights from the management commentary

* Management has raised the tractor industry growth guidance to low double-digit growth from mid-single digits earlier, aided by positive sentiments.

* Dealer inventory is currently less than four weeks.

* The company expects to significantly expand its export footprint once the upcoming greenfield facility becomes operational (likely by FY28). Post this, they expect to commence exports to the US. Escorts would also look at making India a global hub for certain Kubota models.

* The first phase of the project will add 100,000 units of annual capacity (tractors and CE combined) and would add another 1k units in phase 2. The company’s current installed capacity is ~170,000 units, expandable to 200,000 units with minor balancing investments.

* Management expects a gradual recovery in Construction equipment segment demand from mid-3QFY26, aided by the government's infrastructure push. It remains optimistic that margins will recover to high single digits in the second half, aided by normalization of volumes and easing input costs.

Valuation and view

* The outlook for the tractor industry has further improved post-GST rate cuts. As a result, management has raised its growth guidance for the industry for FY26E to low double digits from mid-single digits earlier. However, market share loss for Escorts over the last several quarters remains a key concern.

* Further, while synergies between Escorts and Kubota are significant, they will likely materialize over the medium to long term. However, valuations at ~30.4x/27.9x FY27E/FY28E EPS appear to be already factoring in most of the synergy benefits. Hence, we reiterate our Neutral rating on the stock with a TP of INR3,672, based on ~28x Sep’27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412