NBFC Sector Update : Q2FY26 preview – Asset quality stress a passing cloud by Emkay Global Financial Services

Q2FY26 preview – Asset quality stress a passing cloud

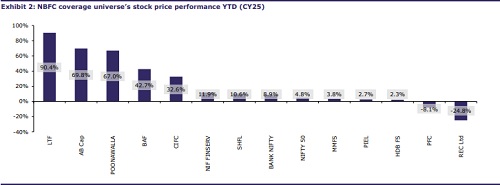

Non-banking lenders in our coverage should likely see broader Q1FY26 trends in growth, margins, asset quality, and credit cost continuing in Q2FY26. At an aggregate level, the divergence in growth between NBFCs and systemic credit will continue, as the superior origination capabilities of NBFCs continue to deliver. On the asset quality front, the continued stress in smaller-ticket loans has likely spilled over to Business Loans, Micro-LAP, and even vehicle loans (to an extent). This increase in stress is largely a customer segment phenomenon (rather than being related to any product segment), and a likely outcome of increased leverage in the customer segment. However, the comforting factor here is that the contribution of these smaller-ticket loans is much lower (low single digit percentage) for the diversified lenders in our coverage. Overall, we see a stable growth trend and slight increase in credit cost, leading to minor moderation in profitability. Following good monsoon, repo rate cuts, and GST cut-led demand impetus, we expect credit cost and profitability to improve in H2, with growth remaining healthy. On a risk-reward basis, we continue to like ABCAP and SHFL. After a material underperformance in YTDCY25, valuation has turned attractive for the power financiers (PFC and REC), and any pick-up in growth can drive outperformance for these shares.

A stable quarter, supported by good rainfall, festive demand, and policy push

We expect Q2 to be a stable quarter in terms of growth, disbursements, and margins. The noise around MSME stress appears to be temporary and is limited to the small-ticket segment; this should ease as business activity improves, aided by good monsoon, strong festive demand, and policy support from the government and the RBI. We expect most of the NBFCs to report improved NIMs as the recent rate cut begins to flow through, with the larger benefit expected in H2FY26. We, however, expect opex to remain elevated for most players on continued investments in tech and capability expansion.

Asset quality steady; MSME stress more cyclical than structural

Asset quality for most players is expected to remain broadly stable amid better customer selection, stricter credit underwriting, and improved collection efforts. We expect credit costs to remain elevated on the continued trend of stress in smaller-ticket loans (which likely spilled over to Business Loans, Micro-LAP, and even vehicle loans to an extent). We expect some normalization in H2 as cashflows improve owing to good monsoon, festive demand, and policy support. In our view, the current concerns around MSME stress are more of a near-term blip rather than a structural risk for the sector.

Power financiers hold firm amid moderated growth

We expect REC and PFC to deliver strong profitability in Q2FY26, supported by recoveries from stressed assets and resilient asset quality. Loan disbursements in the power sector are expected to remain subdued on accelerated repayments by state utilities which likely impacted AUM growth. The recent share price corrections appear to have already priced in this moderation, making valuations attractive. At FY27E P/B of ~1x for REC and ~0.9x for PFC, and with RoEs expected at 16–18%, both stocks stand out as stable investment opportunities, backed by solid fundamentals and ongoing sector reforms.

Macro stability and steady profitability to support valuations

The NBFC sector continues to demonstrate resilience; the sector maintains a steady outlook even as it navigated minor challenges in Q2. The full impact of the recent rate cut should unfold in H2FY26, supported by the RBI’s accommodative stance, firm festive demand, and an improving macro environment. Additional tailwinds such as the GST reduction on durables and vehicles are further aiding the sentiment. Margins are expected to improve as funding costs ease and collection efficiency strengthens, while steady asset quality and stable-to-moderating credit costs should help sustain profitability through the year. Overall, balance sheets remain healthy in our coverage, backed by strong capital buffers, prudent provisioning, and improving asset quality. We remain positive on the sector and prefer ABCAP and SHFL, given their attractive risk-reward profiles.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354