Buy Tube Investments of India Ltd for the Target Rs. 3,680 by Motilal Oswal Financial Services Ltd

Beat on margins across key segments

GST rate cuts and ramp-up of new plants to drive growth

* Tube Investments’ (TIINDIA) 2QFY26 PAT at INR1.86b came in line with our estimate of INR1.78b, even as EBITDA margin at 13.1% was ahead of our estimate of 12.2%. While the engineering business margin was in line, all other segments posted better-than-expected margins.

* We expect standalone revenue to pick up in the coming quarters, led by supplies to a new Hyundai Pune plant that is likely to commercialize from Oct’25, the ramp-up of a new CRSS plant, and the execution of a Railways order. Adjusted for stakes in CG Power and Shanti Gears, the standalone business is attractively valued at 11.5x/10.3x FY26E/FY27E EPS. We reiterate our BUY rating with a TP of ~INR3,680 (premised on Sep’27E SoTP; our valuation is based on 26x PER for the standalone business, valuing the listed subsidiaries at a 30% HoldCo discount).

Earnings in line, while margins beat our estimates

* TIINDIA’s revenue rose 2.6% YoY to INR21.2b (in line). Revenue from mobility/ engineering/metal formed grew 15.7%/4.4%/1% YoY, respectively. The others segment, however, posted a 6.7% YoY dip in revenue in 2Q.

* EBITDA margin improved 120bp YoY (+80bp QoQ) to 13.1% and was above our estimate of 12.2%. While the engineering business margin was in line with estimates, all other segments posted better-than-expected margins.

* EBITDA grew 12.4% YoY to INR2.8b (v/s estimate of INR2.6b).

* Segmental EBIT performance: Mobility margins continued to be positive and stood at 2.2% (est. of 1.5%). Conversely, the Engineering business and metal formed division posted a margin contraction of 40bp YoY each to 11.9% (est. of 12%) and 10.9% (est. of 10.2%), respectively.

* Other income was below our estimates at INR229m (estimate INR250m).

* Hence, PAT at INR1.87b came in line with our estimate of INR1.78b, marking an 11.3% YoY increase.

* Tube investments’ operating cash flow came in at INR3.8b, with capex of INR1.3b undertaken for 1HFY26. Consequently, FCF for TII was at INR2.5b.

* Revenue/EBITDA/PAT for 1HFY26 grew ~3%/ 8%/10% YoY to INR41.2b/ INR5.2b/INR3.5b. For 2HFY26, we expect these metrics to rise 13%/15%/ 14% to INR43.8b/INR5.5b/INR4.8b.

Highlights from the management commentary

* The railway order at the Metal Formed division, which was expected to be commissioned by 4QFY26, is likely to see a delay of one quarter due to a lack of readiness among other suppliers.

* The mobility business’ revenue grew by a healthy ~16% YoY to INR1.9b in Q1. Growth was primarily led by a focus on premium and specialized bikes, the launch of e-bikes, and increased traction in the fitness and leisure segment. Management expects the growth momentum to sustain, which is likely to help sustain margins as well.

* Aided by a new model launch in the cargo EV segment, management expects the 3W EV segment to see a ramp-up from 4Q onwards.

* In TI Medical, management expects recovery from November–December 2025, aided by new product introductions. A growth target of 15% for the near term was maintained, with 25% CAGR over the long term as new verticals are launched beyond sutures.

* For FY26, capex for the base business is expected to be at INR3-4b. They would look to invest about INR4b between their CDMO business and TI Medical, and INR2-3b will be earmarked for potential M&A opportunities in adjacent sectors.

Valuation and view

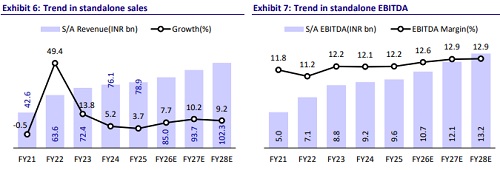

* TIINDIA offers diversified revenue streams, with healthy growth in the core business (~11% S/A PAT CAGR over FY25E-28E), growth in CG Power, and the optionality of new businesses incubated under the TI-2 strategy.

* Adjusted for stakes in CG Power and Shanti Gears, the standalone business is attractively valued at 11.5x/10.3x FY26E/FY27E EPS. We reiterate our BUY rating with a TP of ~INR3,680 (premised on Sep’27E SoTP; our valuation is based on 26x PER for the standalone business, valuing the listed subsidiaries at a 30% HoldCo discount).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)