Neutral Nestle India Ltd for the Target Rs. 1,300 by Motilal Oswal Financial Services Ltd

Improving macros to aid growth; valuation expensive

We interacted with the management of Nestle India (NEST) to discuss the industry outlook, particularly after GST 2.0, growth prospects for its business, profitability outlook, and other focus areas. Here are the key takeaways from the discussion:

* NEST was witnessing sequential improvement in growth delivery, supported by the company’s own initiatives along with steady improvement in macros. GST rate reductions will further boost the FMCG sector from 3QFY26 onward. Favorable monsoon, easing inflation and other govt. measures will also boost demand. More than 85% of NEST’s portfolio has benefited from GST 2.0, though the transition is likely to take time due to old inventory in trade channel. Few more weeks will be needed to clear off the entire old inventory. After 22nd Sep, NEST has instructed its trade partners to sell even old inventory at the revised GST rate. Even price packs of old inventory have seen temporary MRP reduction to pass on the benefits.

* NEST’s portfolio is more suitable to discretionary demand and it sees demand uptrend in positive consumer sentiment. Its confectionary and coffee portfolio has higher sensitivity to price packs and would see more grammage addition to pass on GST benefits. Grammage addition boosts volume and revenue growth (better company realization per pack). Noodles segment’s mix has moved from price packs to large packs over the years (still has high salience of INR15 pack), but it still sees some SKUs of grammage drive. Its milk and nutrition portfolio is largely driven by large packs and has seen MRP reduction. Given the packaged food basket, near-term growth impact in trade transition would be negligible. But full demand benefits are expected to be visible from 3QFY26 onward.

* NEST said that the transition to new GST rates will take some time for products with pre-printed MRPs. Sticker options to update prices have practical difficulties in execution, and it is hard to determine a specific timeline for when channel inventory with old prices will fully settle down and be restocked.

* Unlike personal care, where grammage addition may be compensated by slow pack growth (or contraction), packaged food categories, which are driven by serve-for-one, may not see similar pressure on pack volume. Confectionary, coffee, and noodles may see large benefits of GST 2.0.

* In the backdrop of improving macro drivers, management is hopeful for double-digit revenue growth in the medium term. It would largely be driven by volume growth. NEST has already been focusing on product penetration, the pace of expansion will see acceleration.

* E-commerce, particularly quick commerce (QC), has emerged as a key enabler, contributing 8.6% to sales in FY25 (12.5% of domestic sales in 1QFY26), with QC accounting for ~45%. As per management, QC has been driving campaigns for new products (e.g., NESCAFÉ ready-to-drink cold coffee) and they are well received by consumers. E-com growth also supports onplatform interventions that align with portfolio relevance and evolving consumer preferences.

* The company’s RURBAN strategy continues to drive growth in rural and tier-2 markets. RURBAN markets have been driving growth in recent quarters, signaling a favorable shift in market dynamics and contributing to the overall market resilience. The RURBAN strategy focuses on five pillars: Infrastructure, product portfolio, technology, visibility, and consumer connect. This strategy has led to an increase in RURBAN distribution touchpoints to >28,000, and a presence in >200,000 villages.

* On the margin front, the company has seen gross margin pressure over the last three quarters on account of RM inflation. Commodity prices are expected to ease out, with stabilization in coffee, cocoa, and edible oil prices. However, given the future contract-based sourcing, there can be a lag in margin improvement.

Valuation and view

* Mr. Manish Tiwary has taken on the role of Chairman and Managing Director of NEST, effective from 1st Aug’25. His outlook on the way forward will be the key things to watch out for. Under the new leadership, the company remains committed to driving penetration and volume growth, with continued investments in brands.

* NEST aspires to deliver double-digit revenue growth in the medium term. With its RURBAN strategy, NEST has delivered strong growth in RURBAN markets, with most categories benefiting from improved distribution penetration. The adoption of packaged foods has increased in tier-2 and rural markets. NEST continues to enhance its portfolio through ongoing innovation and premiumization initiatives.

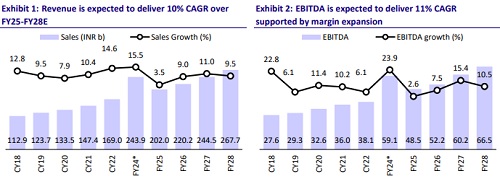

* About 85% of the company’s portfolio has benefitted from the GST rate cuts. Moreover, its product portfolio remains relatively safe from local competition, requiring limited overhead costs to protect market share. In the last two years, NEST has invested ~INR39b in strengthening its manufacturing capabilities to cater to anticipated future demand. We model revenue/EBITDA/PAT CAGR of 10%/11%/12% over FY25-28E. We are constructive on the business and hopeful for potential improvement in growth metrics. The stock is trading at 68x/58x FY26E/FY27E EPS. Given its expensive valuation, we reiterate our Neutral rating with a TP of INR1,300 (based on 60x Sep'27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412