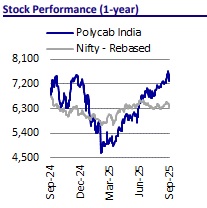

Buy Polycab India Ltd for the Target Rs. 8,750 by Motilal Oswal Financial Services Ltd

Leading the charge in C&W; FMEG turnaround positive

Market leadership in the C&W segment

Polycab India’s (POLYCAB) market share in the domestic organized C&W segment stood at ~26-27%, up from ~18-19% in FY20. The company gained significant market share, backed by a diverse range of offerings (+9,600 SKUs), strong product quality, supply chain agility, deep market penetration (over 4,300 authorized dealers and distributors and presence in over 200k retail outlets across the country). Moreover, the company has consistently maintained a healthy segment margin of ~13-15%, aligning with its guidance of ~11-13%. Under its Project Spring, the company aims to grow its C&W business at 1.5x the industry growth rate, continue gaining market share, and maintain healthy margins of 11-13%.

FMEG delivers turnaround; aims for sustained outperformance

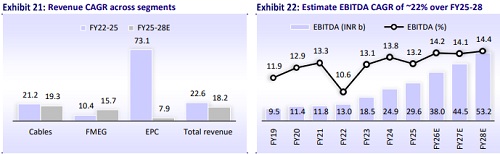

After a muted performance in recent years, the FMEG segment delivered a sharp turnaround with ~29% revenue growth in FY25 and achieved break-even in 4QFY25. This turnaround was driven by its strategic initiatives towards distribution expansion, portfolio enhancement, and brand building over the past four years. The company’s strong performance highlights the growing momentum of its consumer franchise and its ability to adapt swiftly to evolving market dynamics. Under Project Spring, it targets to grow its FMEG revenue at 1.5x-2.0x the industry growth rate, while targeting an EBITDA margin of ~8-10%

Future-ready with 2x capex commitment

POLYCAB has committed a capex of INR60-80b over the next five years (vs. INR30b over FY21-25) to support its long-term growth objectives and build a stronger, future-ready business. These investments are estimated to generate an asset turnover of 4x-5x and will be funded through internal accruals. The focus areas include capacity expansion across all major product lines within the C&W segment, selective expansion in FMEG, and strategic backward integration to enhance operational efficiencies.

Valuation and view: Structurally positive, built for the long term

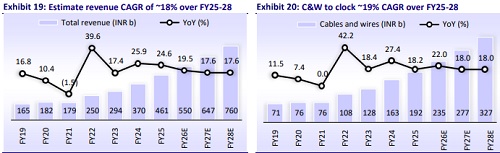

We estimate a CAGR of 18%/22%/21% in Revenue/EBITDA/EPS over FY25-28. POLYCAB has benefited from continuous capacity expansions and sustained a healthy margin (~13-15%) in the C&W segment. We project a stable margin of ~14% over FY26-28, given the company’s operational strength, an increase in contribution from the EHV capacity (expected from FY27), and export growth. Cumulative FCF is expected to stand at INR42.4b over FY26-28, despite increased capex intensity. Net cash is likely to increase to INR47.3b by FY28 vs. INR31.0b as of Jun’25. We remain structurally positive on POLYCAB, given its leadership position in the C&W segment, positive sector outlook, robust balance sheet, and strong return ratios. We reiterate our BUY rating on POLYCAB with a TP of INR8,750 (based on 40x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412