Buy Kajaria Ceramics Ltd for the Target Rs. 1,252 by Motilal Oswal Financial Services Ltd

Focused on building a robust system and process-driven organization

Kajaria Ceramics (KJC) in an exchange filing disclosed a financial fraud conducted by Mr. Dilip Maliwal, CFO of Kerovit Global, a wholly-owned subsidiary of Kajaria Bathware and a step-down subsidiary of KJC. In the analyst conference call, KJC management highlighted that the event will result in a financial loss of ~INR200m, of which ~50% is recoverable. All other subsidiaries have been thoroughly reviewed and no discrepancy has been found. Management has reiterated its commitment to building KJC into a robust system and process-driven organization.

Key highlights from the management commentary

* The company identified certain frauds in its step-down subsidiary Kerovit Global during the implementation of a more robust vendor onboarding process at the parent and in subsidiary companies.

* The issue of fund siphoning is linked to purchase orders of a vendor related to Mr. Maliwal in the INR1.2b capex program in Kerovit Global.

* Exceptional expenses of around INR200m are likely to be recognized in P&L, as per auditors’ instruction.

* Management expects ~50% recovery from the vendor.

* Mr. Maliwal has worked with the company for the past eight years. However, the fraud is believed to have occurred only over the last 1-2 years.

* Kajaria Bathware has terminated Mr. Maliwal from service and filed a complaint with the police.

* All other subsidiaries have been thoroughly reviewed and no discrepancies have been identified.

* Under Kajaria 2.0, management aims for ~INR1.5b in annual savings in areas of raw material procurement (~INR900m), manpower (~INR250m), travel (~INR150m), and salaries (~INR150m), with further scope for improvement.

Valuation and view: Reiterate BUY rating

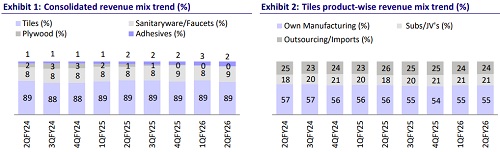

* In line with soft demand and a healthy margin guidance, we expect KJC to post a CAGR of 9%/10%/20%/34% in tile volume/revenue/EBITDA/PAT over FY25-28 (FY19-25: 6%/8%/6%/4%). We also project ~18% RoE, 25% RoCE, 36% RoIC, and annual FCF of more than INR5b for the company.

* In the current soft demand scenario and intense competition from organized brands and Morbi-based players, we believe that sustaining EBITDA margins of more than 18% will be a tall task for KJC. However, medium to long term outlook remains optimistic.

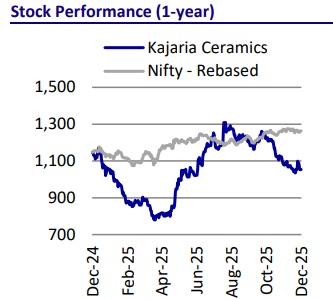

* We retain BUY rating on KJC with an unchanged TP of INR1,252, based on 30x Sep'27E EPS.

* Recovery in tile volumes and sustaining high EBITDA margin (18%+) are the key near-term monitorable to drive a re-rating in KJC's valuation.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)