Neutral AAVAS Financiers Ltd for the Target Rs. 1,800 by Motilal Oswal Financial Services Ltd

AUM growth remains weak; no weakness in asset quality

Earnings beat driven by higher assignment income; NIM expands ~55bp QoQ

* AAVAS Financiers (AAVAS)’s 2QFY26 PAT grew 11% YoY to ~INR1.6b (~8% beat). PAT in 1HFY26 grew ~11% YoY, and we expect PAT to grow ~19% YoY in 2H. NII in 2QFY26 grew 19% YoY to ~INR2.9b (in line). Other income grew 16% YoY, aided by higher assignment income of ~INR700m (PY: INR585m).

* Reported NIM improved ~55bp QoQ to ~8.05% in 2QFY26. Spreads rose ~10bp QoQ to 5.2% (v/s ~5.1% in 1QFY26). Opex rose ~26% YoY to INR1.7b (in line). Opex/assets stood at ~3.5% (PY: 3.2% and PQ: ~3.45%). We estimate an opex-to-asset ratio of 3.5%/3.4% in FY26/FY27E (vs. ~3.4% in FY25).

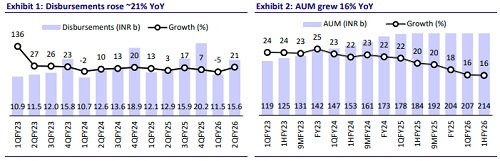

* Management shared that given the current business momentum, it expects AUM growth of ~18% in FY26. Traction in disbursements and AUM growth are likely to improve in 2H, aided by GST-related benefits and positive sentiment for mortgages amid a declining interest rate environment. This should aid housing demand. We model an AUM growth of ~17%/18% for FY26/FY27.

* AAVAS reported a stable GS3, and its 1+dpd improved by ~15bp QoQ. The company highlighted that both its core home market and the newer emerging markets are performing well, supported by its cautiously optimistic underwriting approach.

* Management highlighted that incremental yields continue to be lower than the existing portfolio yields, which may lead to continued moderation in overall yields. The company remains focused on sourcing better-quality customers, even at marginally lower pricing, to sustain healthy risk-adjusted returns over the long term.

* We raise our FY26/FY27 EPS estimates by 4%/2% to factor in higher assignment income. We estimate AUM and PAT CAGR of ~18% each over FY25-28, with an RoA/ RoE of 3.4%/15% by FY28. AAVAS trades at 2.2x FY27E P/BV. For a re-rating in its current valuation multiples, we believe that the company will need to deliver on its guided AUM growth and exhibit better readiness for an acceleration of its AUM growth from FY27 onwards. Reiterate Neutral with a TP of INR1,800 (based on 2.3x Sep’27E BVPS).

AUM rises ~16% YoY; share of HL in 1H disbursements at ~58%

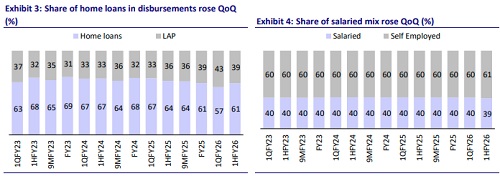

* AUM grew 16% YOY and ~3% QoQ to ~INR214b. Disbursements rose ~21% YoY to ~INR15.6b. Share of HL in 1HFY26 disbursements stood at ~58%.

* Annualized run-off in the loan book stood at ~18.2% (PY: 16.6% and PQ: ~16.2%). Securitization during the quarter amounted to ~INR4.3b (PY: ~INR4.3b), and the securitization margin improved ~380bp QoQ to 16.4%.

Key highlights from the management commentary

* Only ~1.8% of the AUM is exposed to customers linked to US tariff-affected industries. Stress has also been seen in pockets of Karnataka, eastern MP, and certain segments in Gujarat (notably Surat), but this is not broad-based. The company had proactively tightened credit filters in these micromarkets, which has helped contain the impact.

* CARE has revised the long-term credit rating outlook to Positive from Stable, signaling progress toward a potential upgrade to AA+. This is expected to enhance the company’s ability to diversify its liability profile more efficiently and at a lower cost.

Asset quality stable; 1+dpd improves ~15bp QoQ to ~4%

* Asset quality was broadly stable, with GS3/NS3 remaining flat QoQ at 1.25%/0.85%. The company’s 1+dpd declined ~15bp QoQ to 4%.

* Credit costs stood at INR80m (v/s est. of ~INR96m) and translated into an annualized credit cost of ~15bp (PY: ~10bp and PQ: ~22bp). We model credit costs of ~22bp/21bp in FY26/FY27.

A sequential ~17bp decline in CoB; spreads rise ~10bp QoQ

* Reported spreads rose ~10bp QoQ to 5.2% (v/s ~5.1% in 1QFY26), while CoF declined ~17bp QoQ at ~7.85%.

* Within AAVAS’ bank borrowings, ~36% was linked to EBLR and ~25% was linked to sub-three-month MCLR; hence, ~61% of total borrowings were repriced along with declining interest rates. Management indicated that the cost of borrowings is expected to decline in the coming quarters as the benefit from MCLR-linked borrowings gradually reflects in its weighted average cost of borrowings.

* AAVAS’ 2QFY26 core NIM (calc.) improved ~15bp QoQ to ~7%. We model a NIM (as a % of AUM) of 5.3% each in FY26/FY27E.

Valuation and view

* AAVAS posted a mixed performance during the quarter, wherein it reported an earnings beat, driven by higher assignment income, but its AUM growth remained weaker (than expected) as prepayments were elevated. Asset quality held steady, with improvement in 1+dpd supporting lower credit costs. Meanwhile, NIM and spreads continued to expand, aided by a further reduction in its cost of borrowings.

* The company posted RoA/RoE of ~3.4%/~14.3% in 2QFY26. Its continued investments in technology and unwavering focus on asset quality have helped it stand out among peers. Notably, 1+ dpd levels remain well below guidance, supported by prudent underwriting and strong collections.

* The stock trades at 2.2x FY27E P/BV, and any valuation multiple re-rating will depend on stronger AUM growth and delivery of operating efficiencies to further improve the RoA profile. Reiterate Neutral with a TP of INR1,800 (based on 2.3x Sep’27E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)